Property Market Insights – Q3, 2018

Property Market Insights

Quarter 3, 2018

Welcome to the Q3 Market Insights for 2018 from National Property Buyers, where our local agents provide expert analysis of property markets across the country.

Sections: National Market Overview | Victoria | Queensland | South Australia | New South Wales | Case Studies

National Property Market Overview

The market of opinion…..the articles, the news stories, the talk, it is impossible to avoid. The national property market is in decline and has been for 12 months. Australia has just marked its twelve month anniversary for housing correction and is down 2.7%* since peaking last year. And some media outlets are shouting it to everyone and anyone that would listen.

But if you asked us.

Is now a good time to buy?

The answer is yes.

But why?

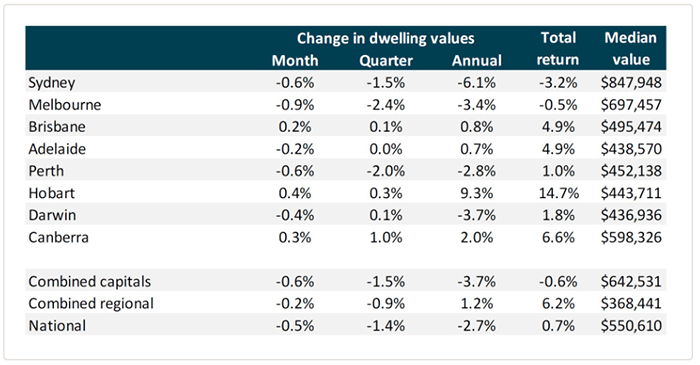

According to Corelogic, Sydney and Melbourne equate to approximately 60% of the value of the national housing market and the negative growth they are experiencing in some suburbs is dragging the national average down. Brisbane, Adelaide, Hobart and Canberra whilst smaller value markets are still recording growth overall.

Weak housing market conditions across the most expensive quarter of properties in Sydney and Melbourne are a key driver of the reported housing downturn. In Melbourne, the highest value quartile has seen values reduce 6.7% over the past twelve months while the lowest value quartile has actually recorded a 4.1% annual gain in values!

But in the words of Noel Whittaker “…the fact is there is no such a thing as a single property market – not for Australia, not even for a single capital city – there are myriad property markets all doing their own thing.”

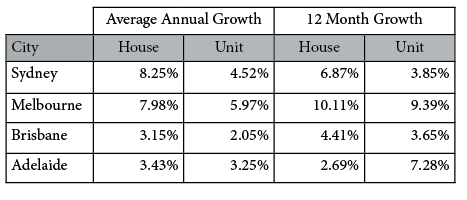

We have reviewed the 44 suburbs we recommended in the last 6 quarterlies (since the start of 2017) for average annual growth (last 10 years) and for the last 12 months. The results might surprise you. In Melbourne, the average annual growth for houses is 7.98% and 5.97% for units. And for the tighter outlook of 12 months, houses 10.11% and units 9.39%. Our Sydney recommendations for houses are showing similar results, the average annual growth is 8.25% and the last 12 months 6.87%. Units are a little lower at 4.52% for annual growth and 3.85% for the last 12 months. Our Brisbane and Adelaide recommendations are showing steady growth as well overall, houses average annual growth around 3% and units 2.05% and 3.65% and 7.28% respectively for 12-month growth. (Please remember we don’t recommend units in all suburbs)

We firmly believe there are great opportunities out there for the savvy investors interested in a medium to long-term hold. But we are not saying you could drop a pin in any suburb and experience growth. It is more important than ever to buy the right property in the right location.

And remember, these statistics include, the good, the bad and the ugly for each suburb. And we only buy the ugly if it is in a good location with plenty of potential!

And for current property owners, despite the recent falls in Sydney and Melbourne, dwelling values remain 46% and 40% higher than they were five years ago, highlighting that most homeowners in these cities continue to benefit from a substantial lift in wealth from the boom in housing.

But what is causing the decline?

The property market cycles and we are currently nearing the bottom of a decline phase. Which may be surprising for some but it is the best time to buy with due care. But why are we in this stage of the cycle?

This correction has been brought about by the deliberate actions of governing bodies and regulators.

Back in March 2018, the banks were restricted by APRA to increase their interest only lending for new residential mortgages to 30% (the preferred loan type for investors), on top of the annual 10% cap on investor credit growth introduced in 2014. Since July 2018 the 10% cap was lifted but lenders have reduced their appetite for high debt to income ratio lending and positive credit reporting is being enforced. Tighter lending restrictions for local borrowers means it is harder to get finance especially due to the impact of scrutinisation of ‘Discretionary Living Expenses’. Couple this with tighter regulations for foreign investors it means there are less investors in the marketplace which means less competition. This reduced appetite for high debt lending is also making it difficult for owner occupiers to buy in the highest quartile of the more expensive Sydney and Melbourne market.

Why did the government and regulatory body bring in these changes? To stop unsustainable growth and to ensure that mortgagees are able to service their loans for the long term ensuring we avoid a mortgage crisis.

The current political arena is also impacting the property market, with Australia’s merry go round of Prime Ministers and the impending federal election is also causing the less confident investors to “wait and see”. The Labour governments proposed reforms on capital gains and negative gearing has investors choosing between a rock and hard place.

What is keeping the property market growing?

The pillars of a strong property market are still in place:

- Strong population growth – Queensland is the most popular destination for people moving from other states, according to the latest population figures released by the Australian Bureau of Statistics. Queensland recorded a net interstate migration gain of 24,000 people, Victoria was the next most popular state, with a net gain of 15,100 people. Net overseas migration added 236,800 people to the population and accounted for 62 percent of Australia’s total population growth. NSW continues to top the polls though with the highest population.

- Low unemployment – Australia’s seasonally adjusted unemployment rate stood at 5.3 percent in August of 2018. The jobless rate remained at its lowest level since November 2012, according to tradingecomonics.com and ABS.

- Low-Interest Rates – The Reserve Bank has left official interest rates on hold for a record 26th month at a record low rate of 1.5 percent in September. Though some lenders are raising their rates out of cycle of the RBA.

- Infrastructure growth – There is significant infrastructure growth being built or planned around Australia. For example, more than $100 billion worth of new roads, rail lines, hospitals, skyscrapers, prisons, wind farms and other infrastructure is being built or planned in Victoria as the state’s surge in the delivery of major projects gathers pace. Sydney is developing light rail and satellite cities. Adelaide has won a $50 billion contract to build Australia’s new submarine fleet. And Queensland state budget has $45.8 billion pinned for infrastructure development over the next 4 years.

For the savvy investor and owner occupier, this is a great time to buy before the property clock switches into a growth phase again. But have a clear goal, do your due diligence and buy the right property for you at the right market price.

Read our in-depth analysis of our major property capital cities for market insights, suburb hotspots, and infrastructure activities.

Market Overview

State Overview

Well, we were pipped at the post this year. Melbourne has finally been ousted as the worlds most liveable city. I guess we will just have to be happy with second place after 7 years of being number one! Interestingly, this year it was our best score in eight years, we received 100 percent in health care, infrastructure and education while recording improvements in the areas of culture and environment.

Congratulations Vienna, we will see you next year in the battle for the crown!

It is the end of the winter season in Real Estate and everyone is buoyed by the prospects of a busy Spring period.

Melbourne, along with Sydney, has experienced price growth correction and is easing slightly. This is not necessarily an uncontrolled correction in the market. It was brought about by deliberate efforts by the Government and Regulatory bodies. APRA’s tightening of lending criteria continues to have the desired effect and is ensuring that people taking out our new loans are more than likely going to be able to service them long term. It has significantly reduced the number of investors securing new loans which has removed considerable competition from the market. In addition, the tightening around foreign investors by placing additional fees/surcharges has also further reduced competition from investors.

However, owners of properties shouldn’t be too disappointed. Melbourne has enjoyed many years of strong growth. The correction we are going through at the moment is being felt more in the high end of the market (properties $1.5 Million+) as that segment of the market is experiencing the least growth overall, recording a 5.2%* drop in growth over the last year. The more affordable part of the market has experienced a 6.0% rise in the past year.

It is a great market for First Home Buyers and the Mum and Dad investor with small to medium budgets, as the market has transitioned to a buyer’s market. First home buyers are currently dominating the sub $750,000 price range for small houses, townhouses, villa units and older style apartments in boutique blocks.

There continues to be well performing suburbs, with some recording double digit 12-month % growth. And Melbourne still remains as one of the strongest performers long term compared to the other capital cities. There are great buys out there. You just have to know where to look.

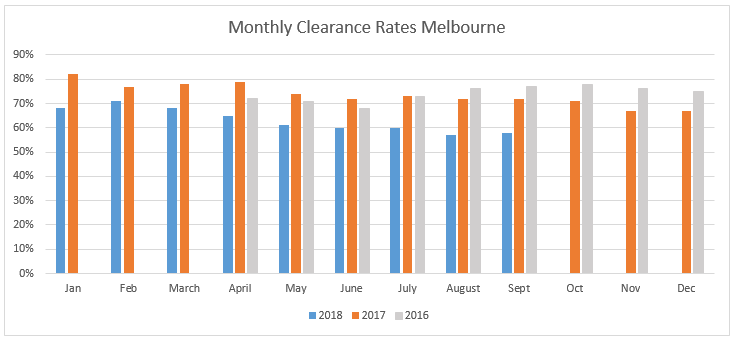

Auction Clearance Rates

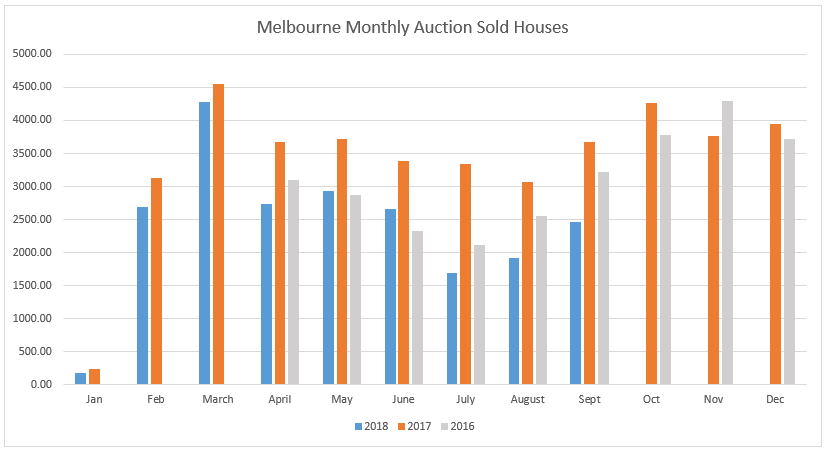

There is no denying that Auction Clearance Rates have dropped. They are currently sitting around 60% compared to 70% at the same time last year. Properties selling under the hammer have reduced due to a lack of competition. Whilst more properties are passing in, the good ones are selling that day or soon after, so it pays to be the highest bidder at auction to make sure you are in the box seat for negotiations.

Some Vendor continues to list their properties with unrealistic expectations but if they keep their expectations in line with what the market is prepared to pay the listing will move and sell.

Sold

Advertised inventory levels are rising and this is simply due to a slower rate of absorption. This is great news for buyers, more choice means less competition and less urgency. However, there are markets within markets and good properties in good locations will always draw interest and will perform well in just about any market.

There continues to be an oversupply of apartments around the CBD, Southbank and Docklands and we strongly recommend you seek independent and professional advice before investing in these areas.

Economic Indicators

Economic indicators remain strong for Melbourne.

CommSec released their quarterly “State of States” report that outlines the performance of each state on an economic basis. Victoria has taken the top spot for the strongest performing economy – knocking New South Wales off top spot for the first time in four years. This comes off the back of Victoria’s strong population growth and low unemployment levels. The Victorian government has committed to a 35-year expansion plan to counter exponential levels of population growth. A major part of the plan is to transform Melbourne into a polycentric city (not a city centralised around one main centre). With the city expected to overtake Sydney as our most populated over the next 15 years, there is a need to promote suburban job centres – rather than rely on the city CBD as the only major job centre.

The Andrew’s government has also proposed one of the biggest changes to public transport infrastructure in Australia’s history. The proposal is to bolster the city’s transport network with orbital connections stretching from Dandenong to Werribee. The SRL (Suburban Rail Link) if approved will connect major hospitals, university centres and employment area without the need to travel into the city then out again. It will cost an estimated $50 billion, carry an extra 400,000 passengers per day and create an additional 20,000 jobs over the construction time frame and it propped to be completed by 2050. It will be the biggest change to public transport infrastructure program in Australia’s history, providing up to 90km of rail line and taking 200,000 vehicle trips off major roads.

Summary

The property market will always travel in cycles and corrections will occur. It’s like any other asset class. For the savvy property buyer, the next 12 months presents a good opportunity to buy well. Property still remains a very good long-term investment vehicle and is one of the best performing asset classes if you purchase the right property at the right price at the right time. Most homeowners in Melbourne have seen a substantial wealth booster with values remaining 43% higher than when bought 5 years ago, and 77% higher than 10 years ago.

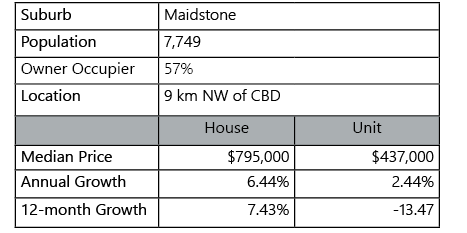

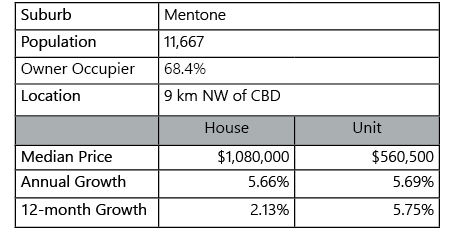

Maidstone - "Surprising Package"

Overview

The surprise suburb that offers it all.

Maidstone is only 9kms northwest of the CBD and next to proven performers such as Seddon, West Footscray and Maribyrnong. The suburb of approximately 9000 people (2016 Census) is surrounded by parks, the Maribyrnong River and the Medway Golf Club. There is ample walking, cycling and exploring that can be completed on leisurely weekends.

Maidstone or neighbours of Maidstone provide all that you could need. There is good schools in neighbouring suburbs and Victoria University is situated nearby. The majority of locals drive into town but there are plenty of other options including regular bus and tram services. West Footscray Station (Zone 1) is located a stone throw away and at only 5 stops into town worth the small walk, 1.6 km to 2km depending on where you live in Maidstone. Maidstone has its own collection of shops, medical centres and cafes but for more hustle and bustle you can enjoy the lively café culture of West Footscray nearby. Including hugely popular Dumbo and West 48 café.

For endless shopping options catch a bus or drive your car for 4 minutes and head to High Point Shopping Centre.

Maidstone labour force has traditionally been employed in the manufacturing sector, but due to its proximity to the CBD and people being forced out of its more expensive neighbours more professionals are snapping up properties in Maidstone. Larger older homes that were cheaply built are being knocked down and making way for townhouses and villa units. Wides roads with nice footpaths rub shoulders with more established suburbs for the discerning buyer. Maidstone, is all about knowing where pockets to buy in, avoid the commercial areas and find yourself a nice suburban street.

Locals on homely.com.au give Maidstone a “thumbs up” and “a hidden gem”. Prices are steadily heading north as people realise what Maidstone has to offer. And if you love the Spring horse racing season Flemington Racecourse is the perfect distance away, close but not too close!

Purchase Example

Purchased for $657,000 in September 2018 by a young couple who wanted a home that would benefit from capital growth in the future.

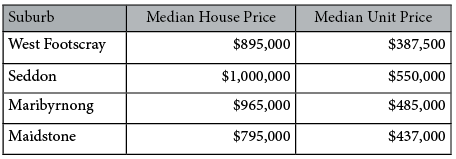

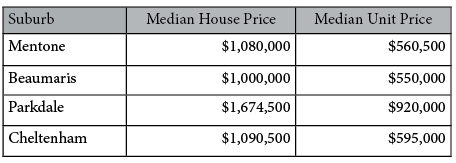

Mentone– “Your Beachside Education”

Overview

The commutes a little longer into the CBD from Mentone, at 21kms, but this Bayside suburb is the place to be. Offering endless lifestyle appeal this beach suburb has every amenity you need. Excellent public transport, shops, cafes and medical centres.

Mentone is renowned for its prestigious schools, as it resides within the zone of many top Bayside schools. Mentone Grammar School, Mentone Girls Grammar and St Bede’s are all located in Mentone. And depending what part of Mentone you are in, you will also qualify for public secondary colleges Parkdale or Sandringham. These schools and beachside proximity are major drawcards to the suburb and attract affluent families to the area.

The best parts of Mentone are near the village. Initial works to remove the level crossing at Balcombe Road to ease congestion is due to start in late 2018. A new Mentone Station will be built as part of the project and community and council are working closely together to ensure the level crossing removal, and new station integrates with existing heritage buildings. Construction will take around 18 months.

Plenty of parks and trees make Mentone a very green area which the local council maintains nicely. There has been a couple of unattractive apartment developments approved by Kingston Council but they serve a purpose with more affordable dwellings and higher density living.

If you need to get your shopping fix there are multiple options available nearby including Southland Shopping Centre (4kms), DFO Moorabin (3.5kms) and Chadstone (12kms) a little way down Warrigal Road to satisfy your retail needs.

There is some light industrial areas west of Moorabbin airport which should be avoided for buying residential properties if possible. This area immediately west of the airport is not as highly sought after.

This suburb of 12,965* people is well placed to continue performing well in the future and is definitely an alternative to those priced out of Beaumaris and would prefer more convenient public transports options.

Purchase Example

View the agent listing here. Purchase Price $950,000

Overview

Q3 Average Vacancy Rate 1.6% – NPB Q3 Average Vacancy Rate 1.6%

Typically Winter is the quiet season but we have been busy with many lettings this quarter. Usually, in Winter there is not much demand, but this winter has been busy with demand and supply has been fairly matched.

Victoria has consistently enjoyed some of the lowest vacancy rates in Australia according to SQM Research the current vacancy rate for Melbourne is 1.6%. Properties that are well priced and presented typically leased after one open. On the eve of the Grand Final Public Holiday, we opened a property for the first time in Ardeer. The property offered excellent value for money, near new 2 bedroom villa unit with all the mod cons. We had 15 groups through and received 10 applications, it was open Thursday night and it was leased by Tuesday. Lifestyle and inner city suburbs continue to be popular, but renters are also enjoying the bang for the buck you get in suburbs like Ardeer which are commuting distance to the city but you get a lot more property and land for your dollar. We are finding properties that were purchased through our Buyer Advocate services are continuing to be snapped up by tenants faster than other properties. The weekly median rent for houses in Melbourne is $527.7 and for units $408.8.

by Antony Bucello

Director and Victorian State Manager

0418 131 950 or email me

Market Overview

Sydney is currently the focus of negative media attention when it comes to the real estate market and it seems that Sydney can’t win at the moment.

Two years ago, the media shouted about the unaffordability of Sydney and that property prices were grossly disproportioned to salaries and incomes. Now that we are experiencing a controlled correction of property prices the media spotlight is on a market crash rather than correction.

There is no denying that the Sydney market has slowed. Dwelling values have fallen since July last year and are now down a cumulative 5.6%. However, the housing market correction has been heavily concentrated around the premium sector of the market and there are many suburbs still experiencing growth.

Would it be daring of me to say we are in a normal market?

We are not experiencing the crazy and unsustainable growth of the last 2 to 5 years but conversely, we are not experiencing a plummeting property market either. We are experiencing a deliberate and controlled correction of unaffordable price growth. Tightening credit conditions around loans, including reduced debt to income ratios have reduced the number of investors in the market and owner occupiers who can no longer secure loans for Sydney’s premium properties. An increase in fees and charges for foreign investors is also reducing buyer numbers even further. Buyers are no longer scrambling for properties with the same sense of urgency that Sydney was experiencing in the past. Fewer buyers mean less competition.

Who does this correction affect the most?

Traditionally, successful property investment has always been a long-term game, anyone who has purchased in the last 2 years and is in a situation where they have to sell now may well lose money. On the flipside, first home buyers have hit the market and are taking advantage of the ability to buy property they couldn’t afford 12 months ago.

Despite the falling value of some properties, the vast majority of home owners are holding

a strong equity position as residential property values remain 49% higher than 5 years ago and 83% higher to 10 years ago.

It is now more important than ever to buy the right property in the right location. Economists are anticipating the Sydney market will remain flat for a while so now is actually a great time for the savvy investor or owner occupier to buy before the property cycle returns to a growth phase.

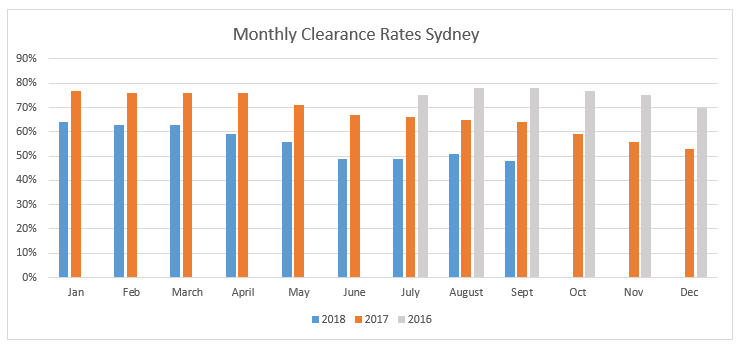

Auction Clearance Rates

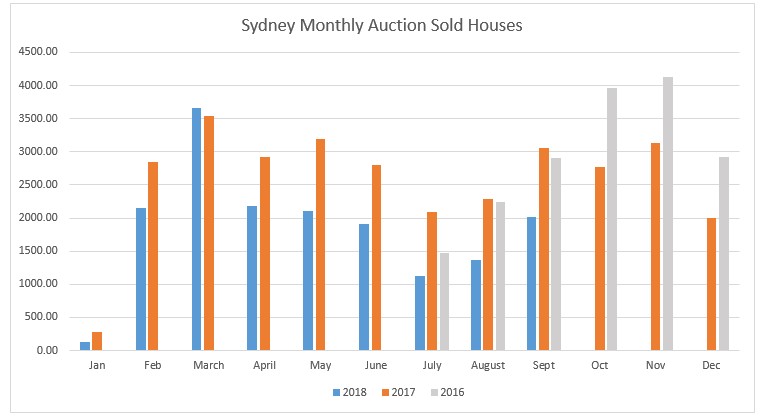

The clearance rate has dropped in Sydney. Last year the clearance rate hovered in the 70th percentile whist this Winter quarter we have average 55%. With reduced competition in the market properties are less likely to sell under the hammer and as days on the market increases inventory stock levels are rising due to a slower absorption rate. Buyers are being more selective about the properties they are interested in. Sellers need to make sure their properties are appealing to buyers: present it nicely, tidy the gardens, and if funds are available, a fresh coat of paint and professional styling can all contribute to a property standing out from the crowd. Seeking professional advice on preparing and presenting a property for sale can be the difference between an average and fantastic sale result.

As mentioned above fewer properties are selling under the hammer and that can be seen below in the number of houses sold at auction per month. There has been an obvious dip in the market over the winter months and we are expecting to see an increase inline with the usual Spring market pick up however we doubt it will reach the levels we saw in Spring 2017.

Economic Drivers and Infrastructure Activities

Sydney continues to be a popular destination for overseas and interstate migrants. The city has the largest city population in Australia and is one of, if not the biggest, job centre hubs in Australia.

Sydney is landlocked by National Parks and can only spread so far before land becomes scarce. For this reason, we continue to see more high rise apartment buildings in certain areas to service those who prefer compact, easy living near a train line or CBD transport. With the Sydney CBD becoming so congested we are seeing the Satellite cities of Parramatta, Chatswood and even Ryde / Macquarie continuing to grow. With some big brands choosing to establish their head offices in these suburbs, these areas have become major employment hubs of their own and property prices around are reflecting these changing conditions.

In September, Prime Minister Scott Morrison kicked off construction on Sydney’s second airport at Badgerys Creek. The airport will be at the centre of the Aerotropolis – a business precinct, surrounded by 10,000-hectares of cutting-edge industries, businesses and homes, which will bring a further 200,000 jobs to Sydney’s west. Four universities have signed on to develop a world-class aerospace, engineering and science institution in the forthcoming Aerotropolis.

The federal government has pledged $3.6 billion towards upgrades to local roads and highways, in particular, the M12, to connect the Western Sydney Airport to the motorway network and CBD. Airlines Virgin and Qantas have already committed to the new airport, with initial plans for premium domestic services operating from day one in 2026.

The New South Wales government is pushing to have its troubled Sydney light rail project ready by late 2019. The $2.1 billion project was originally meant to be delivered by early next year, but has been plagued by delays, costs blowouts and legal battles. Transport for NSW’s CBD and South East Light Rail, linking Circular Quay via George Street and Central, to Randwick and Kingsford, is under construction and will open to customers in 2019. It will join the Inner West Light Rail, already in service, with light rail projects for Parramatta and Newcastle in the planning stage.

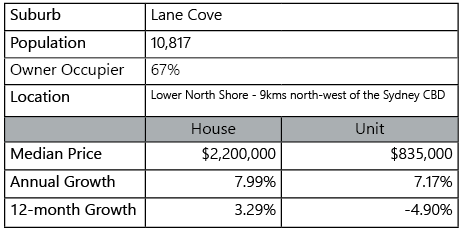

Lane Cove - "Riverside suburb that has it all"

Overview

Lane Cove is a suburb on the Lower North Shore of Sydney and surrounded by lush parkland and recreation facilities. Don’t miss out on this opportunity to buy in a prestigious, rejuvenated suburb only 9 kilometres from the Sydney CBD.

The suburb has undergone huge growth in recent years, with tired apartment being replaced by modern high-rises positioned with envious river views and easy access to upgraded amenities, such as local shops and schools.

Currently underway and due for completion in mid-2020 is the major “Rosenthal” project to transform a surface level car park to a state of the art public open space including parks, performance spaces, BBQ facilities, 500 additional car parking spaces and a retail precinct including two anchor tenants, ALDI and Coles and improved access to Lane Cove Plaza.

The Lane Cove Plaza is a popular gathering point for locals, with boutique shops, cafes and restaurants and a Coles and Woolworths. There are 2 local libraries and an Aquatic Centre with a well-equipped gym all at hand. Easy access to the two major Shopping Centres 4km away at Chatswood means locals have the best of village living and access to all major retailers and cinemas at their fingertips.

Another major drawcard is the express bus service into the city for commuters, taking less than 10 minutes from the Epping Road bus terminal. Alternatively, a 10-minute drive will get you into the heart of George Street in the CBD.

Lane Cove is a family friendly place with an enviable lifestyle. Over time the older residents have been joined by young families and the demographic is changing. There is an abundance of primary schools in the area offering plenty of choice, including Currambena School, Lane Cove Public School, St Michael’s School. There is one high school for boys, Saint Ignatius’ College, Riverview in Lane Cove and more high performing public and elite private schools in nearby suburbs.

And if that wasn’t enough, according to the Australian Bureau of Statistics, Lane Cove is one of Australia’s top-10 most advantaged local-government areas. Entry-level pricing for two-bedroom units is now around $750,000 with buyers able to choose between older, walk-up style units with well-proportioned floor plans and contemporary newly built units. Houses typically range from $1.75 million to $3 million.

Purchase Example

View agent listing.

Willoughby - "Community and Family"

Overview

Willoughby is one of the most desired and exclusive family suburbs in Northern Sydney. Renowned for its classic Californian-Bungalow architecture and relatively flat topography it offers today’s residents a vibrant community lifestyle with bustling restaurants, cafes, fashion boutiques and sports parks.

Willoughby is located on the Lower North Shore of Sydney and is only 6 kilometres north of the Sydney CBD.

It has a number of boutique shops, restaurants and hotels and is also home to the headquarters of the Nine Network. A stone throws away is the world-renowned shopping precinct in Chatswood.

Local schools in Willoughby are leading the field in academic ratings and placements at Willoughby Public, Willoughby Girls and St Thomas Catholic Primary and are all highly sought-after.

There are plenty of parks, reserves and a great leisure centre for families and active residents. Bicentennial Reserve which includes Hallstrom Park, features a soccer field, T Ball and softball fields and a children’s playground. Willoughby Leisure Centre features a 25m lap pool, spas, children’s pool, gym, basketball courts, netball courts and baseball field. And for a leisurely walk Flat Rock Gully, has bushland with two walking tracks to Long Bay, following the creek line.

Express transport options throughout the area afford Willoughby the luxury of easy access to Sydney’s CBD, Northern Beaches and local Business Parks. Artarmon is the nearest station for Willoughby’s residents, on the western border of the suburb. It is also close to St Leonards and Chatswood railway stations. And there are a number of bus routes that cover the area. And for those that prefer to travel by car the Gore Hill Freeway, is a major arterial route into the Sydney CBD and runs along the southern border of Willoughby allowing residents quick and easy access to the CBD, Eastern and Western suburbs.

Over recent years property prices in Willoughby have sky rocketed as buyers have looked to this suburb as an alternative to the surrounding suburbs of Chatswood and Crows Nest. Homes in Willoughby are typically Victorian / Federation style and many have been snapped up and converted into luxurious modern style homes. There are very few unit blocks in this suburb and most feature oversized art deco style apartments that have previously been popular among young couples, down sizers and investors. Given the low supply and close proximity to the CBD, the unit market in Willoughby is tightly held.

Purchase Example

View agent listing.

by Simone Luxford

State Manager New South Wales

0429 039 558 or email me

Market Overview

Brisbane median house price hits record high!

Brisbane’s median house price has hit a new high, with market growth up 30 percent in the past five years.

The latest Real Estate Institute of Queensland Market Monitor released, reveals Brisbane’s median house price increased 2.5 percent in the past year to hit a record-breaking $673,000.

Noosa, not wanting to be left in the shadows has become Queensland’s powerhouse property market stealing the crown – and headlines – from the Gold Coast as the strongest growth market in Queensland. Noosa’s annual median house, unit and land price grew in the range of 6 to 12 per cent over the 12 months to the end of June. In June, Noosa’s median house price of $695,000 was about $22,000 more expensive than the median house price in Brisbane LGA of $673,000.

We have been enjoying our mild winter here in Queensland while our more southern neighbours have been complaining bitterly about the cold. Our property market is benefiting from sustainable and moderate growth. There has been a decline in advertised listing volumes. And this reduced availability of stock has narrowed the purchase options for buyers and when a good property is listed in a good location, competition is stiff and drives prices north. The market is still erring in favour of the seller but there a plenty of good opportunities for buyers who know where to look and how to negotiate. The flavour of the quarter for buyers is properties/blocks that offer development opportunities. We have experienced increased demand for blocks that can be subdivided or have 2/3 townhouses built on them. This type of property is reasonably scarce in good areas and can be difficult to source.

Though we have noticed less investors in the market overall as APRA changes make it more difficult to secure interest only investment loans. We are finding that investors that cannot afford the expensive markets of Sydney and Melbourne are attracted to the stable, sustainable growth that Queensland can in the correct locations. The first-home buyers grant extension for new dwellings has been extended for an additional 12 months. However, the grant has been reduced to its original level of $15,000 from 1 July 2018.

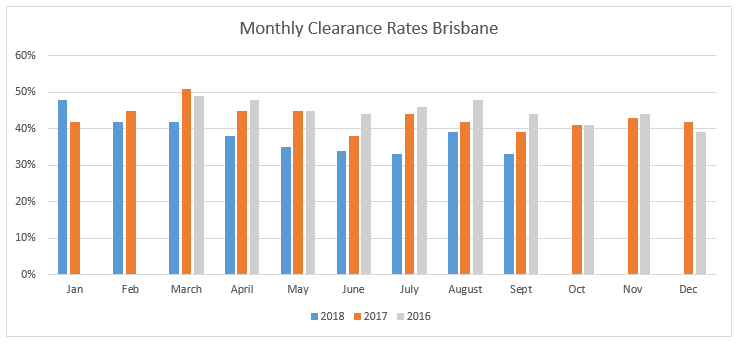

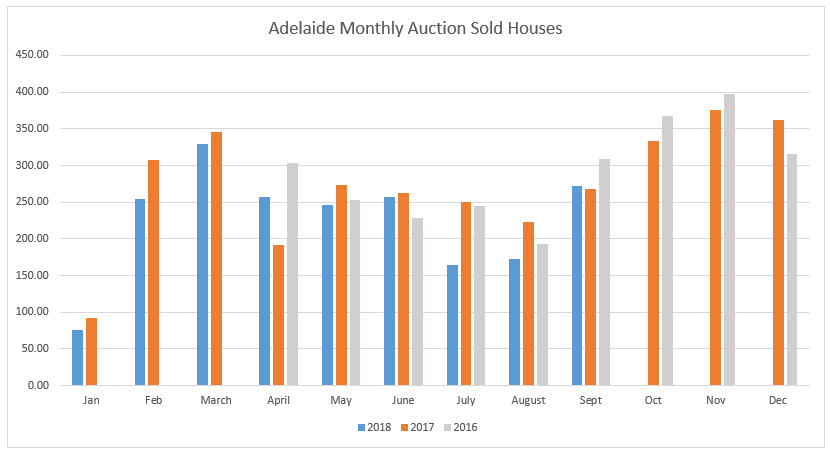

Auction Clearance Rates

We have enjoyed steady clearance rates for the Winter quarter and in early September achieved high clearance rates. We are traveling on par for the winter quarter compared to last year which is different from some of the capital cities where auction clearances rates have been trending down.

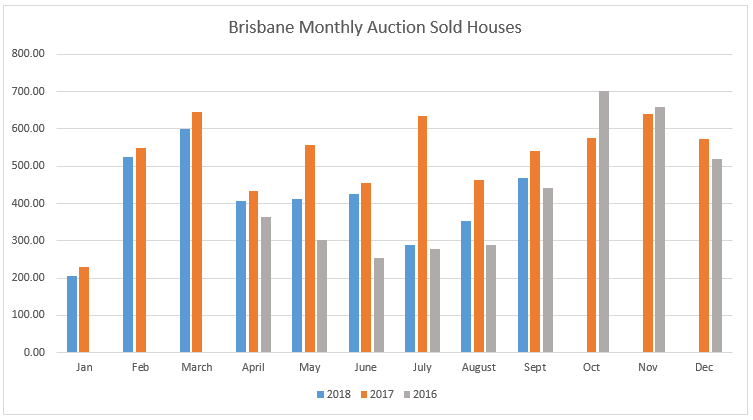

Sold

We experienced a dip in the number of sales in July but this was due to reduced listings. We are finding that properties are spending least time on the market. For example, Ferny Hills and Chapel Hill both reduce their days on market from about 50 days to 34 and 32 respectively. Shorter listing period is a good indicator that the market is speeding up.

Economic Indicators

Queensland continues to enjoy the driver’s which make it popular. The eternal quest for warm weather and coastal lifestyles drives population growth from interstate and overseas migrants. And good population growth is good for property growth.

The state budget released in June this year delivered $45.8 billion for infrastructure investment over the next four years to support 38,000 jobs. About $4.2 billion will be invested on transport and roads infrastructure, including funding to the Sunshine Coast rail line, the Cross River Rail, the Toowoomba Second Range Crossing, the Bruce Highway and the Pacific Motorway. The infrastructure program for 2018-2019 is estimated at about $11.6 billion. The health and education sectors’ capital works funding was in the vicinity of $986 million and $1.1 billion, respectively. This funding will expand and improve the health infrastructure and the education facilities of schools and TAFE campuses across the state.

Ahead.

There is considerable activity in the Queensland property market and sentiment is high. We expect a burst of increased listing in early Spring. The beginning of Spring does entice people to sell as we naturally think about growth and new opportunities. However, we do not expect a large sustained variation in listings.

Queensland continues to offer good growth and affordable investing.

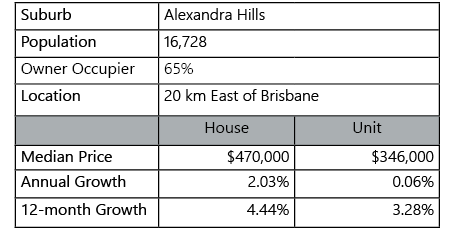

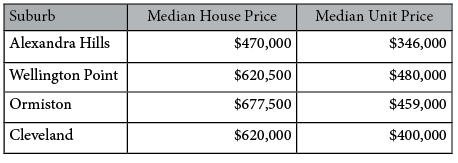

Alexandra Hills - "Surrounded by everything you need"

Overview

Alexandra Hills shares its borders with Wellington Point and Ormiston which are coastal side suburbs in Redland Shire. Alexandra Hills is approximately 20 kilometres east of Brisbane and a 40-minute drive (55-minute peak) will get you into the CBD.

Wellington Point and Ormiston have become very popular with owner-occupiers due to their beachside location with great parklands and nature reserves. For buyers in the sub $500k range that are now priced out of these suburbs (for a reasonable house) Alexandra Hills is a great alternative. It is a stone throw from all that Wellington Point and Ormiston have to offer but with a more moderate price tag.

Alexandra Hills has all the necessary amenities to underpin good growth. Good shopping, including Alexandra Hills Shopping Centre. transport, education and medical facilities including Redland Hospital which is located just outside of its eastern borders. Good schools plus a TAFE in its border make this suburb very appealing to families.

Nestled between Alexandra Hills and Cleveland is Scribbly Gum Nature reserve so if you enjoy walking and bike trails, birds and wildlife definitely a place to check out on leisurely weekends. And if you prefer blue to green you can visit one of the 4 different waterside suburbs nearby, Wellington Point, Victoria Point, Raby Bay and Cleveland.

If you can’t find what you are looking for in Alexandra Hills next door is the main shopping centre and transport hub of Capalaba. The Capalaba shops have everything you could possibly need. It also offers great cafes, bars and restaurant. It is a popular place to visit for a night out.

Alexandra Hills is a fantastic, safe place for families and anyone wanting a relaxed lifestyle. It is quiet and leafy with decent size blocks and with all these it has to offer its price can only head up.

Purchase Example

View agent listing.

Geebung - "Growing Reputation"

Overview

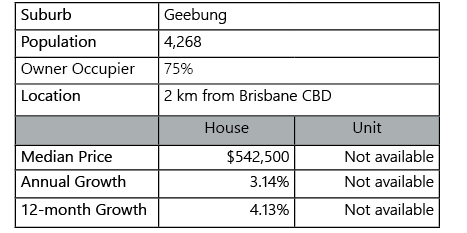

Geebung is a Northern suburb 12 clicks out of the CBD and has enjoyed 38% growth in the last 5 years – the majority of that occurring in the last 2 years. Its popularity has grown as its more expensive neighbours, like Wavell and Virginia, are forcing first home buyers and investors to look elsewhere.

Geebung is an affordable area with a rapidly growing reputation. A lot of the land holdings are in elevated streets so these houses are the fastest moving properties and mostly all will need renovating to the buyers ideal. They may also provide great breezes and views which along with the improvements to local schools and the nearby Westfield shopping center are all proving to be the drivers for growth.

Geebung wears its industrial heart on its sleeve and many of its old sheds have been transformed into social attractions and activities including a skate park, motorcycle museum and cafes. One of Geebungs famous landmarks is Sultans Turkish Restaurant with belly dancing and traditional food and music on offer.

Geebung has some great transport links with Direct Rail and Bus Services. Dissecting the suburb is the North Coast Rail Line which has two stations in Geebung, Geebung and Sunshine.

In the neighbouring suburb is Chermside Shopping Centre, which is the 2nd largest shopping centre in Australia by number of stores. It has everything you could possibly need.

Purchase Example

Vacancy Rates and Median Rents

Rental Market

Brisbane Q3 Vacancy Rate 2.8%, NPB Q3 Vacancy Rate 0.98%

The rental market showed an increase in enquiries in the first half of the quarter, slowing down towards the end of the period. There is still a reasonable amount of demand for houses in most areas, but the unit market still remains very competitive.

Looking ahead, the next 6-8 weeks are historically slower with enquiry levels, but seems to pick up towards the end of the year with tenants looking at getting organised for the coming year.

The vacancy rate for Brisbane at the end of the quarter was still a high 2.8%, while NPB vacancy rate remains low at only 0.98%. Median rental rates for the quarter were:

End of Q2 – Houses $447 Units $336

End of Q3 – Houses $451 Units $371

The Queensland State Government has just announced that they are looking at reforming the current legislation in regard to renting in Queensland. They are now taking submissions and conducting surveys from tenants, landlords and Property Managers. If you wish to submit to this reform, the link is below:

www.yoursayhpw.engagementhq.com

by Stephen McGee

Queensland State Manager

0488 501 170 or email me

Market Overview

Well, Adelaide is feeling a little proud of itself.

At the end of August, Adelaide was named the nations new top performing capital for property price growth. It even knocked off the much talked about Hobart off its perch.

According to Corelogic’s Hedonic Home Value Index, Adelaide’s dwelling values rose by 0.5 percent over the 3-month period ending August 31st. The highest increase recorded by any capital city.

Adelaide’s buoyant housing market is being driven by demand from locals and interstate investors. Mum and Dad investors that can no longer afford Adelaide’s more expensive sisters, Melbourne or Sydney, are turning to Adelaide. For those lacking confidence in the traditionally juggernaut real estate markets of Sydney or Melbourne or are seeking to diversify their portfolio, Adelaide represents a stable, affordable alternative.

Interestingly, whilst Melbourne is always bragging that it is the most liveable city in the world, did you know that Adelaide received 10th place in the Economist Intelligence Unit (EIU) annual survey this year. Not bad, considering that 140 cities are ranked on a range of factors, including political and social stability, crime, education and access to healthcare.

The winter period in Adelaide has seen a shortage of quality stock. This placed vendors of quality property firmly in the box seat due to increased competition for these rarer listings. Unfortunately, this cannot be said for vendors sitting on lower quality stock in less desirable locations. Buyers demand continues in the inner metropolitan ring, like North Adelaide, Norwood and Prospect or lifestyle suburbs like Brighton, Semaphore and Henley Beach. Newer homes in desirable suburbs are being snapped up, affordable price points combined with low maintenance living are attracting investors and owner occupiers alike. Character homes continue to be popular as always, particularly in lifestyle suburbs.

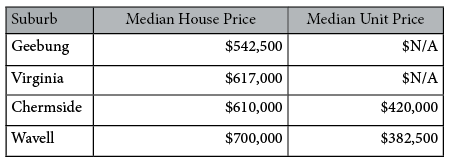

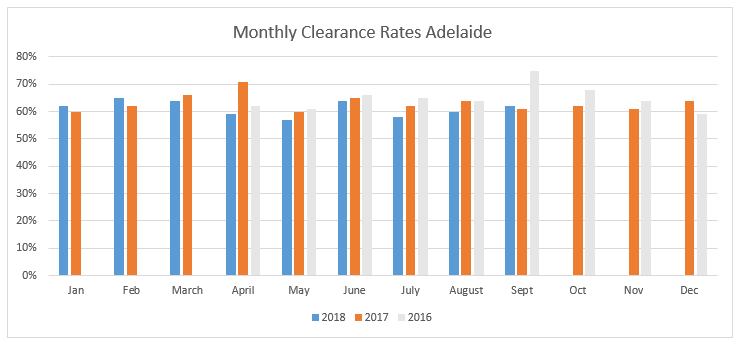

Auction Clearance Rates

Whilst Adelaide’s auction market is reasonably small compared to the larger auction driven markets of Sydney and Melbourne. Our clearance rate is stable and behaving more consistently with previous years. And really it is the less desirable properties that are struggling at auction.

Sold Houses

At a glance, there appears to be a significant drop in the number of sold houses in the winter months, however, the reality is it is due to a lower number of advertised stock. Even in the first few weeks of Spring we are seeing more listings hitting the market and real estate agents are knocking on our doors to tell us about all their “great” properties which will be listed soon. We are confident that more quality stock will hit the market in Spring and will be snapping them up as quick as we can for our savvy buyers.

Economic Indicators

The South Australian budget has been handed down for the 18/19 financial year and whilst nothing directly targets investors there are a few items that could improve the profitability of their portfolios. Land tax reform will bring in a lower marginal tax rate from 1 July 2020. The tax-free threshold will increase to $450,000 from its current $369,000. Marginal tax rate will see a reduction from 3.7 per cent to 2.9 percent for land ownership between $1.2 million and $5 Million.

The SA government plans to spend $11.3 billion on infrastructure for the four years following the 18/19 financial year. Significant investments are allocated for road, education and water infrastructure. There are allocations for funding for tourism, industry, innovation, roads and transport, health, education, cost reduction and regional areas.

Next Quarter

Spring is always heralded as the time to sell and as mentioned we are already seeing more listings and active Real Estate agents are already contacting us about their upcoming properties. Prices will continue to increase and good stock will perform well.

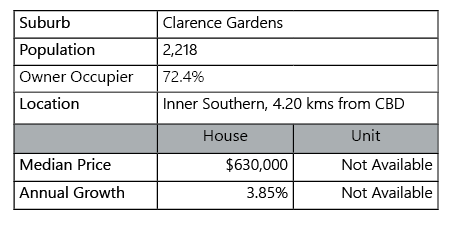

Clarence Gardens - "Bursting with Pride"

Overview

Clarence Gardens is becoming an extremely desirable suburb. If families or professionals can no longer afford the inner ring of Adelaide they are filtering through to suburbs like Clarence Garden. Located in the inner south about 5 kilometres out of the CBD.

Even though Clarence Gardens is only 1 square kilometre it offers big blocks with old homes on them. There are a lot of lovely streets in Clarence Gardens, often wide and tree lined. It is not overrun with subdivisions and new builds.

Good bus routes surround the borders of Clarence Gardens with two trains stations (Emerson and Edwardston) on its outskirts. The closest shopping centre is Castle Plaza (2kms) which offers a Target, Flight Centre, Newsagency, Michel’s Patisserie, Foodland, Coles and many other retailers. The popular Avoca Hotel has been renovated and offers good pub meals in a nice atmosphere. A great place to catch up with friends and unwind.

Edwardstown Primary School, just outside the suburb border is one of the main primary schools in the area and can be as little as a 3-minute drive or 10 minute walk depending where you live.

Interestingly units perform quite well here, typically in Adelaide houses perform better but in Clarence Garden both dwelling types are enjoying growth.

Clarence Garden is a lovely suburb to live in and its 2,200* residents know it and take pride in their homes and gardens. Homely ranks Clarence Gardens the 8th best suburb in Great Adelaide, with locals stating 15 minutes will get you anywhere you need to be! And with its dual lifestyle appeal, easy access to the CBD or beach, is well worth checking out.

Purchase Example

The home has been tastefully renovated throughout and is well suited to most buyer types, especially a family or entertainer. There’s three (3) large double bedrooms plus a fourth (4th) bedroom or study. The master has an ensuite and walk in robe. Purchase price $755,000. View the agent listing here.

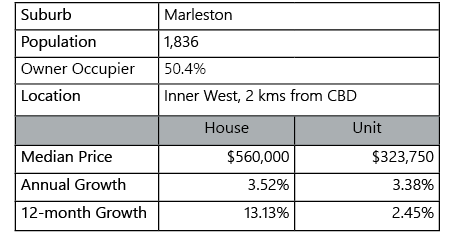

Marleston - "Tiny but Mighty"

Overview

Historically, Marleston has been overwhelmed by the popularity of its neighbouring suburbs (Kurralta Park, Glandore, Richmond) but buyers are becoming more aware of what Marleston has to offer. And this can be seen its double-digit 13.13% value growth in the last 12 months.

Marleston is an inner west suburb and a leisurely 2 kilometre walk would get you into the CBD. It is a small suburb of 1 square kilometres with a population of approximately 1836.

A short drive or walk can provide you access with everything you need. It provides easy access to the popular beaches, including West Beach, Glenelg and Henley, on one arterial road.

Good bus routes dissect and border the suburb. The airport is close by for any commuters or frequent travellers. And whilst it small border do not house a school of its own, there are nearby schools in neighbouring suburbs such as Richmond Primary School and the sought after Adelaide/Botanic High Zone.

There are many beautiful bungalows in Marleston, some of have been given new life and some are waiting for the discerning buyer to restore it lovingly. Block sizes are generally generous for this small suburb. Ranging from 500 sqm to 1100 sqm. A small number of larger blocks have been subdivided with modern townhouses replacing older properties.

There are readily available amenities – shops, restaurants, childcare, sporting grounds, medical centres all within short distances.

At only 5 minutes to the CBD and still a quiet, peaceful neighbourhood there are great buying opportunities for families and professionals. We don’t think these affordable prices will hang around for long.

Purchase Example

Vacancy Rates and Median Prices

Adelaide Q3 Average Vacancy Rate 1.4% – NPB Q3 Average Vacancy Rate 0.01%

While the market has been quieter coming out of the cooler months, quality properties, with a fair rental value have still been snapped up by great tenants. We have found a mix of units and homes in inner city suburbs such as Norwood and Rose Park have leased well as well as Glenelg and Hove for seaside living and school zones.

Tenants are loving low maintenance. Busy lifestyles and a love of entertaining mean they want the space and ability to have a bbq with friends, but not a huge yard where all the spare time is taken maintaining that.

We have also found an increase in a number of younger renters hitting the market, for their first time. This can be something owners can be hesitant about, but often, those with steady jobs are actually quite good tenants as they want to set up a good rental history and show their independence and ability to maintain their own home.

We have leased a number of properties during the quarter within a week of advertising. One, a unit at Rose Park was listed, advertised, leased and tenancy commenced all within 4 days, you can’t get a much quicker turnaround than that! We are finding tenants are ready to go; bond in the account, ready to transfer, boxes packed, all they want to do is sign the lease and collect the keys. This is making it really important if the property is vacant, to have any maintenance completed, the property clean and ready to a new home to the successful tenants.

As the weather continues to warm up, the rental market often follows. Increasingly until December with families, in particular, finding homes ready for the new school year. Quality homes, with space inside and out, in popular school zones are tipped to become the most sought after. Beachside, lifestyle living is a close second.

by Katherine Skinner

Buyers Agent and Senior Property Manager

0438 729 631 or email me

We have prepared four case studies on properties we purchased in Q2 for our client’s.

Off Market Opportunities Knock (VIC)

Suburb: Maidstone

Listing: Off Market

Client type: Owner Occupiers

Budget: $650,000

Property: This 2 bedroom townhouse on 150 sqm is located within a stone’s throw to West Footscray. Our soon to be married clients wanted a home that offered proximity to the CBD, great lifestyle options, capital growth and all for an affordable price.

Solution: After missing a place (a 2 bedroom unit on a block of 3) in Yarraville at auction, the agent approached us with an off-market opportunity in Maidstone. This property was a standalone 2 bedroom townhouse on its own title. We discussed this opportunity with our client as Maidstone is only 5 minutes away from Yarraville and offers more bang for your buck. Our clients decided they were prepared to make a small sacrifice with location in order to get a superior property.

Purchase: We submitted an offer on the property subject to a building inspection. Some minor defects showed up in the report and we renegotiated $2k off the sale price.

Smart Investing Opportunities are Back (NSW)

Address: 49 Mackenzie Avenue, Woy Wou

Client type and budget: Our client, a young Sydney couple, already own a few investment properties in Melbourne and were looking for a property closer to home and the beach with the view to eventually retire in one day. They were keen to secure a property that was close to the beach, train station and local shops and amenities. With a strict budget of $750,000 we suggested considering the Central Coast where it is possible to invest in property now with a reasonable rental yield and good average capital growth rate return (base on the last 10 year growth rate average). We provided the necessary suburb statistics and research for our clients to consider and it was a no brainer that the Woy Woy / Umina Beach area ticked their boxes for a quality long term investment property.

Property: An original 3 bedroom home with a north facing rear yard and rear lane access. The property also has a 1 bedroom council approved granny flat in the rear yard separated from the main house by a fence and completely private. There is also an oversized 2 car lock up garage to the rear of the property. With two dwellings on the land this property offers dual income.

Solution: This property ticked all our client’s buying criteria and was well within their budget, in fact, we purchased the property for $40,000 under their original budget. With a long standing tenant in place who desperately wanted to stay on and a granny flat to provide additional rental income this property offers approximately a 5% yield and 7% year on year growth for the past 10 years. Perfectly located within a 4 minute drive of Woy Woy train station and Umina town centre and beach this property is a quality long term set and forget purchase.

Purchase: Given that the market has started to slow we were watching this property among other properties for a good few weeks. The main draw card for this property was the council approved granny flat and the opportunity to renovate both it and the main house to add value. With a long term tenant in place the idea of renovating the main house will wait for the future however, the granny flat was vacant so our clients would be able to renovate it straight away achieve a little more rent and put a tenant in it quickly. We were able to do our research on the property and we found that it had been on the market for some time and was overpriced when it was first listed. It had stayed on the market for a while and of course most buyers were shying away from it, thinking it was a stale sale. We did our due diligence and began negotiations. The property was originally listed with a price range of $760,000 – $810,000 and was then adjusted to $700,000 – $750,000. After almost 2 weeks of negotiation we secured this property for a very pleasing $710,000! Our clients then engaged us to project manage the renovation of the granny flat which only took 3 weeks!

Relocate with ease (SA)

Client type and budget: Relocating Family from Melbourne

Bought For: $1,425,000 on 05 Aug 2018

Property: 5 Bedrooms, 2 Bathrooms

Property:

Impressive in scale and positioned on a prime corner allotment, this grand double story villa offers spacious, light filled interiors with an abundance of living options. Presenting period elegance alongside modern conveniences and both upper and lower level master suites, the home is ideal for growing families and is located in a prestigious, highly sought locale. Offering both formal and informal living and dining options, the home offers a flexible floorplan with up to five bedrooms, both master suites with walk in robes, two bathrooms, undercover parking for two cars and a sparkling in-ground heated pool.

Set for easy access to local amenities along Duthy Street, Cross Road and Unley Road café and shopping precincts, quality local schooling including Concordia College, Highgate Primary School and Walford Girls and easy CBD access with public transport links, made this property very appealing.

Solution:

Our clients family were relocating from Melbourne and asked us to find and secure them a new home. In addition, our Melbourne office also assisted them with selling their Melbourne home. This alleviated a significant amount of stress for our clients, knowing that one company was taking care of all their needs.

Searching through what was available online and through our network of sales agents, we found this amazing home for them in Malvern. A family friendly suburb with a prestigious school nearby that all 3 children could attend. The home matched all of the family’s requirements and we started the process to secure the home as theirs. Through negotiations with the sales agent, as well as working through our purchaser’s preferences, the home was secured under budget and under the asking price of the vendor.

Retire with Style (QLD)

Client Type: Downsizers

Scenario: We were approached by our client, to help them sell their family home in Kippa-Ring and then assess and negotiate for their new home they found in Deception Bay.

Suburb: Kippa Ring

Listing Guide: $490,000 – 500,000

Sold Price: $500,000

Suburb: Deception Bay

Budget: $350,000

Listing Guide: $349,000 to $359,000

Bought Price: $340,000

Our clients found us through Google and liked what they saw on our website and contacted us to assist them in selling their home and assess and negotiate for their new home.

First, we assisted them with putting their current property on the market, we recommended several local real agents based on recent agent results in the area and sales analysis of surrounding. We assisted in defining their marketing strategy and negotiated the cost of it with the selected real estate agent.

We decided on an auction campaign due to the popularity of Kippa Ring. We received 4 offers in the first week of the campaign. The property passed in on auction day but we worked with a buyer from the first week of offers to secure a fair price for both parties.

Our clients had found their dream home in Deception Bay, but didn’t want to let emotion drive their decision and how much they would pay. They engaged us assess and negotiate for their home. We completed our due diligence and organised a building inspection.

The listing guide was $349,000 to $359,000 but I believed we could get if for less and we ended up securing the property for $340,000. We used the results of the building inspection to negotiate a further discount of $5000. Our clients were ecstatic.

Our clients have paid off their mortgage, topped up their super and have some money in the bank for annual travels. What an outcome!