Property Market Insights – Q4, 2017

Property Market Insights

Quarter 4, 2017

Welcome to the Q4 Market Insights for 2017 from National Property Buyers, where our local agents provide expert analysis of property markets across the country.

Sections: National Market Overview | Victoria | Queensland | South Australia | New South Wales | Case Studies | Rental Wrap Up

National Property Market Overview

We are experiencing a two-speed market!

Good stock in prime locations – close to desired amenities, schools, shops, lifestyle options and infrastructure are performing well. But there is no doubt at a macro level the property market has slowed.

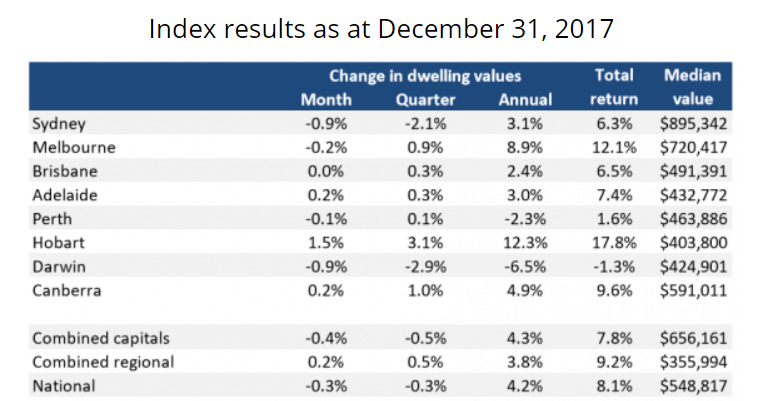

The latest figures from CoreLogic take national dwelling values lower than the previous quarter and into the negatives for the first time since the three months ending April 2016. This is due to falls in Australia’s largest housing market Sydney. Sydney accounts for around 1/3 of the total value of the national housing market. The fall in Sydney is relatively minor to date when you consider that between February 2012 and July 2017 Sydney property prices increased 75%.

According to CoreLogic head of research Tim Lawless “In 2017 we saw growth rates and transactional activity gradually lose steam, with national month-on-month capital gains slowing to 0% in October and November before turning negative in December.”

Annual Growth for the year still remains positive in the markets we focus on. Melbourne achieved the highest growth 8.9%, followed by Sydney 3.1%, Adelaide only .1% behind on 3.0% and Brisbane 2.4%.

What are some of the factors influencing the market?

Population growth has been positive with Victoria leading the charge with 2.3% increase from the previous year. Unemployment across the board has fallen from 5.6 to 5.4%. The Reserve Bank recently held rates at 1.50%, the 15th consecutive hold since the RBA made its last move in August 2016.

The dust appears to be settling on a number of federal and regulatory bodies legislative changes. Investors are finding it harder to secure interest only loans and the holding costs of investment properties has increased. It is more important than ever for investors to work with a trusted team of advisers – including Buyers Agents, Mortgage Brokers and Quantity Surveyors. Investors can no longer knock on one banks door and expect an interest only loan to be offered they must work with high grade mortgage brokers to source the best loans available in the market. Quantity Surveyors can still reduce the holding cost of investment properties and ensure you are maximising your depreciation of assets.

Predictions

At a macro level, we expect price growth to slow in Q1 2018. The Reserve Bank of Australia (RBA) is likely to hold the official Interest rates for the duration of 2018 as there is significant household debt in Australia and lifting rates could cause financial stress. Property values have surged in Sydney (75%) and Melbourne (59%) over the last 5-year growth cycle and it’s rational to expect some slippage in dwelling values across these cities.

We believe it will continue to be a two-speed market with the quality properties in good locations continuing to enjoy growth, albeit at a more moderate pace. The reduction in investors in the market, moderate price growth and stamp duty concessions can make it a good time first home buyers to get into the market, so we expect to see more activity from them.

Our Buyers Agents are continuing to educate our clients that quality properties are still demanding higher prices due to competition. Similarly, Real Estate agents are working hard to adjust the opinions of Vendors and Buyers alike. Buyer’s expectations, fuelled by some media outlets are too low, believing they can pick up a bargain in a great location and vendors expecting prices to soar over reserve effortless will also be disappointed. There is a middle ground and it must be reached to achieve a sale.

We continue to be wary of any “Off The Plan” purchases for apartments as investments, and if you are looking at apartments for owner occupier purposes, negotiate hard and be prepared that if you do come to sell in the future you may not recoup your cost. We exhibited recently at the Sydney Property Buyer Expo and found that many attendees who approached us had disappointing experiences in the past with buying House & Land packages in new outer ring estates as investments…..they simply had not grown in Capital Growth. The common theme was that they had attended a “One Stop Shop” seminar where the facilitator could handle the finance, conveyance, property selection, etc. We do not recommend this type of housing stock as a long-term quality asset to grow your wealth but if you do go down this path – do your research!

It will be an interesting start to the New Year with new listings to hit the market and we are pleased to say we have had an increase in motivated buyers already knocking on our door to engage our services in all States – and we can’t wait to get into it!

Please read on for further insights into Sydney, Melbourne, Brisbane and Adelaide, including suburbs to watch in 2018.

Market Overview

What a run-up to Christmas. November was our busiest month for the quarter, if not year. Everyone loves to put their properties on the market in Spring when gardens look their best and weather is nice for property hunting. Stock levels were good and demand remained consistent.

More stock on the market though thins the competition and the market leaned in the favour of buyers. Q4 offered some good opportunities for savvy buyers to make smart purchases as vendors needed to offload properties after buying new properties of their own.

The added stock levels have affected the clearance rate as buyers can be more selective about their purchases. Overall the market has stabilised and whilst we are still experiencing growth it is not at the rapid rate of the past 5 years.

The inner 10kms of the CBD still remains popular with townhouses with the right attributes – prime locations, good floor plans and low owners corps being snapped up. These properties are attracting first homes buyers, downsizers and investors. A little further out but still an easy commute to the CBD around the 20kms mark we saw properties that represent good development opportunity. For example, medium to large block sizes with a modest house were being scooped up for their future development potential. In the short term, they may offer a lower rental yield but it is their future growth that investors are banking on.

Future infrastructure plans around Melbourne include the North East Link that has been approved. The North East Link will connect the West Ring Road and Eastern Freeway. Suburbs that will benefit from this extension include Greensborough, Watsonia, Macleod, Viewbank and Heidelberg. We don’t expect any action on this until 2020 but as these suburbs are linked via new infrastructure and become more accessible, property price growth could occur.

Last quarter our report focused on a number of regulatory body and legislative changes that have impacted the market. We have seen a reduction in the number of investors in the market, but this provides opportunity for downsizers, upsizers and 1st home buyers to make some good buys as competition has thinned.

There are grumblings that the lending climate is going to continue to get stricter, particularly around servicing a loan. Banks may need more proof of your living expenses and won’t be able to use ‘average’ amounts. We recommend finding an experienced mortgage broker if you are being impacted by these changes as you may need to knock on more than one door to get your loan pre-approval.

Q1 traditionally starts off reasonably quiet with people enjoying school and summer holidays. The frenzied activity leading up to Christmas takes a break and we anticipate there will be little activity in the market until mid-January to early February. However, it is always worth watching the market in case there is a great property out there.

Mordialloc - “Best kept coastal secret”

Snapshot

Overview

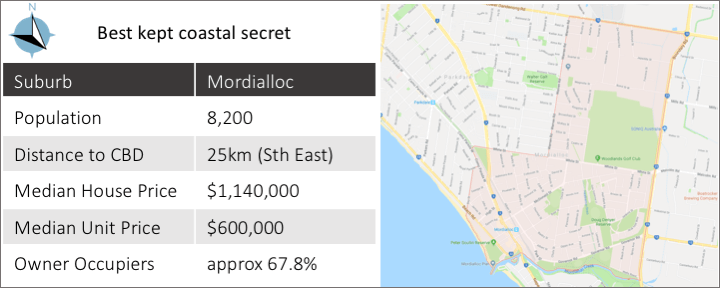

Mordialloc is located 25km south-east of the CBD and is a bayside suburb with a population of approximately 8,200.

Some claim Mordialloc is one of the best kept coastal secrets. It is a great lifestyle suburb offering cafes, restaurants, the beach and access to the city (via car and train). Local primary and secondary schools are steadily improving and are now offering some great choices for families.

If buying in Mordialloc you need to know where the right pockets are. You don’t want to get too close to the airport or flight path and as you continue east towards Braeside there is a significant industrial zone. For those in the know, the pocket around Mordialloc train station offers some fantastic residential opportunities.

Traffic can become congested on the main roads and side streets around Mordialloc. However, in May 2017, the Victorian Government committed $300 million in funding to build the Mordialloc Bypass by late 2021. The Mordialloc Bypass is a proposed new 9km arterial road between the end of the Mornington Peninsula Freeway at Springvale Road, Aspendale Gardens and the Dingley Bypass.

The new bypass will help combat delays and improve safety in one of outer Melbourne’s fastest growing areas. The reduced traffic volumes on Springvale Road will improve bus operations, which, together with the provision of a shared pedestrian and cycling path along the Mordialloc Bypass, will provide a more balanced transport network solution for the area.

There is lots to enjoy in Mordialloc, so pay it a visit and check out the beach or enjoy a few rounds of golf on one of the courses.

Pricing

According to CoreLogic the median price of a house in Mordialloc is $1,140,000 and for a unit $600,000.

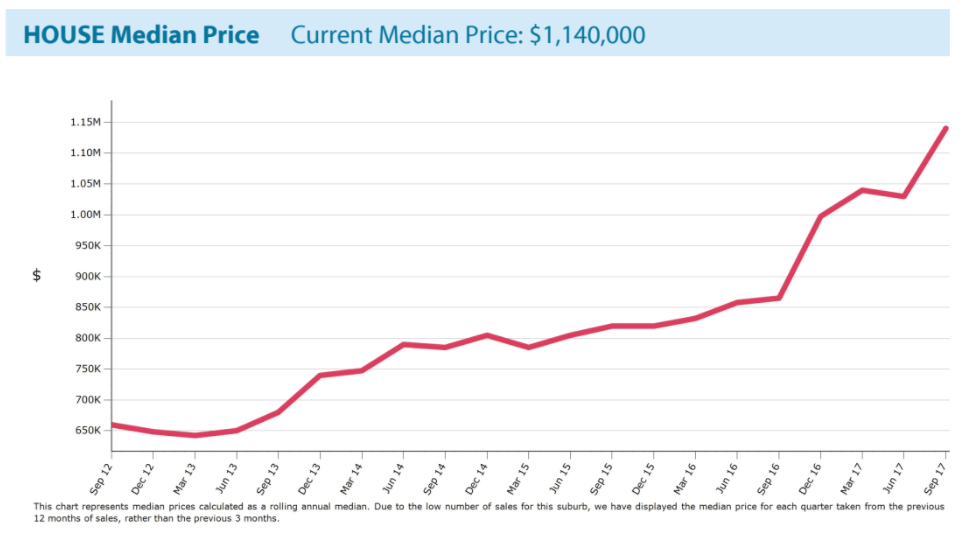

Trend in Growth for Houses

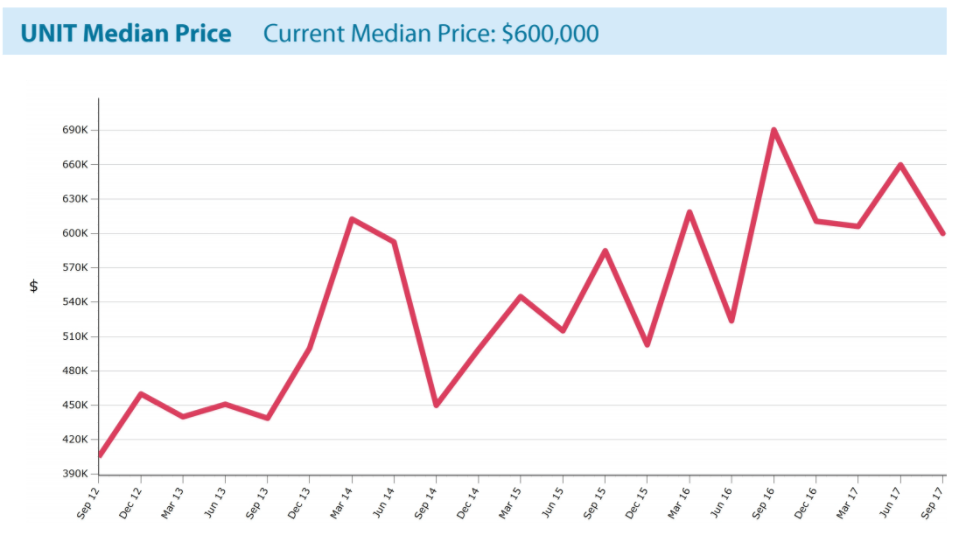

Trend in Growth for Units

Coburg – “Inner City Quality”

Snapshot

Overview

Coburg is conveniently located 8 kms North of the CBD and with a population of approximately 27,000 and is a melting pot of culture. The suburb has a strong multicultural influence with local residents born in Italy, Greece, Lebanon and Turkey.

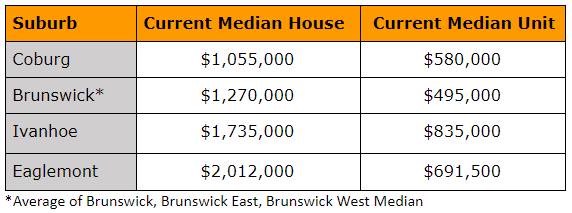

As home buyers get priced out of its more expensive neighbours of Brunswick, Ivanhoe and Eaglemont the suburb is slowly gentrifying and leaving its unruly reputation behind it.

Coburg offers a range of lifestyle attractions including popular primary schools, local parks, Merri Creek and weekly markets. The main commercial centre Sydney Road is the longest shopping strip in Melbourne; it is filled with cafes, restaurants and Coburg’s renowned shopping precinct. Sydney Road boasts two renown gastropubs and restaurants “The Post Office Hotel” and “The Woodlands Hotel” – both feature in The Age Good Food Guide and have a hip and urban following.

Coburg has excellent transport options, with two train stations, trams and access to main roads heading into and out of town (West Ring Road, Hume Highway, Tullamarine and Calder Freeway). The roads can get a little congested though as this thriving metropolis ferries it’s people around.

Coburg is reaping the benefits of the ripple effect as buyers can’t afford it’s neighbours and start looking next door. Coburg is well worth a look, catch a tram down Sydney Rd, grab a meal at The Post Office or Woodlands Hotel and think about buying in Coburg before prices are driven further north!

Pricing

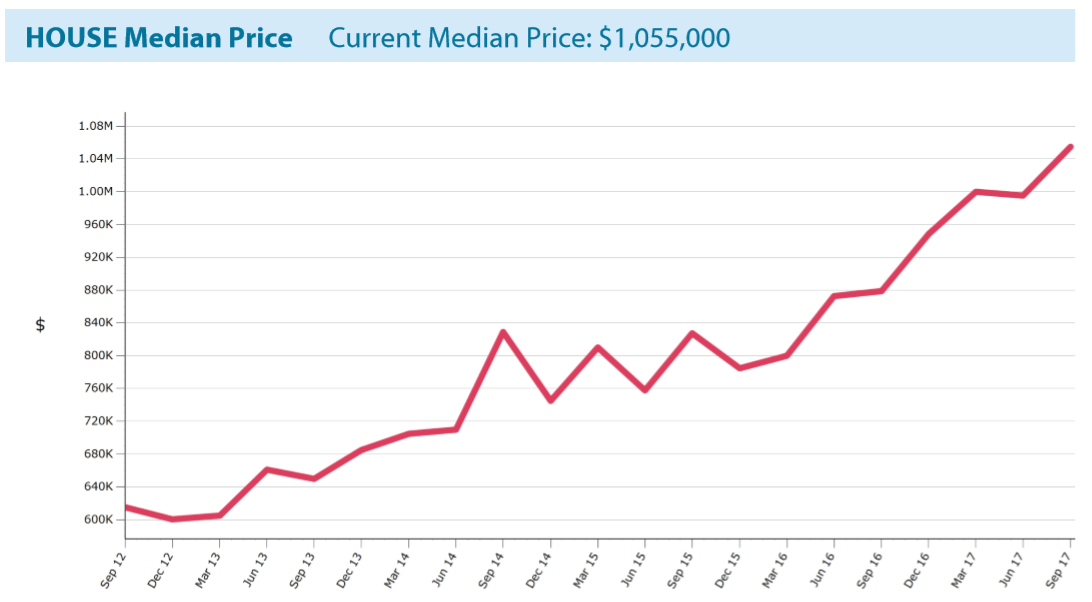

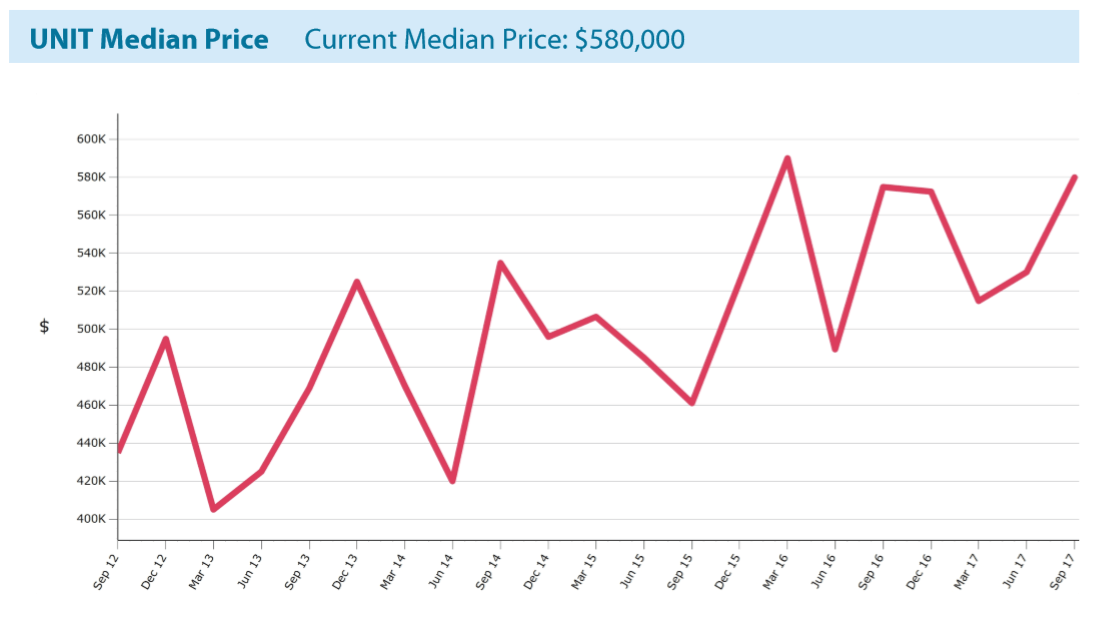

According to property data from REIV the median price of a house in Coburg is $1,055,000 and for a unit $580,000. Coburg’s more expensive neighbours are forcing buyers to look elsewhere and their gaze is turning more and more towards Coburg.

Current Median Pricing 2017

Trend in Growth for House Pricing

Trend in Growth for Unit Pricing

As you can see below the unit market is more volatile whilst house growth has been more consistent.

by Antony Bucello

Director and Victorian State Manager

0418 131 950 or email me

Market Overview

Continued lack of good stock is still driving the market in Brisbane. Vendors selling in established areas – with land, access to amenities and infrastructure that supports reasonable access to the CBD are doing well. Buyers are paying a premium to acquire this stock. Buyers are still out in abundance and the movement is being generated by internal migration and international migration. The lifestyle that Brisbane has to offer is also a factor when attracting buyers whether they are upsizing or downsizing.

During Q4 80% of the buyers we conducted property searches and purchases for were investors. Smart investors should be buying in areas that are largely owner-occupied and not follow the majority if house and land packages are being offered in new areas. Areas in Brisbane that are experiencing growth are the outer lying areas (15-20km from CBD) where suburbs are more affordable and attracting investors and owner occupiers with lower amounts to spend (approx. $400K). Likewise, the inner ring around Brisbane (0-6km from CBD) continues to experience growth. It is a more expensive area (approx $800K) and more volatile but they are experiencing higher rates of growth. The middle market (6 to 15km from CBD) is the largest market and less volatile, there is less activity occurring in this market and as such it remains relatively stable.

Owner Occupier purchases have progressively slowed down in Q4. If they have been unable to find the right property or have been missing out at auctions/tender before Christmas they put the brakes on. Some owner occs will look at renting to see them through the quiet period (January/early February) and will look afresh when more stock comes on the market. Typically, we have about 60% investors and 40% owner occupiers on our books but at the moment we have about 80% investors and 20% owner occupiers.

The apartment market, inner city, high-rise will continue to drop, we believe this market has not bottomed out yet. If people have bought new apartments off the plan they will hurt when they try to sell them. Typically, we advise against buying in this market for investors but if you are interested as an owner occupier you should negotiate hard.

Whilst there is limited new infrastructure projects in Brisbane there is a large project nearing completion. The M1 North Gateway Arterial motorway should be complete in about 6 months. The Northern suburbs (20-30Km) will become more attractive as ease of access to the CBD is completed.

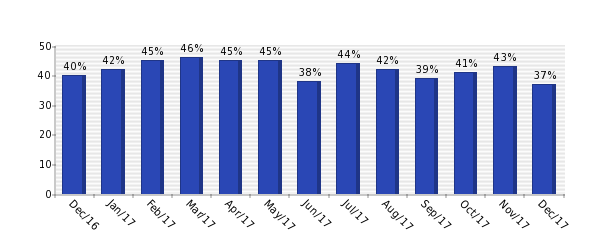

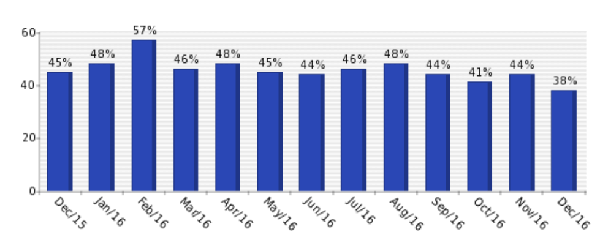

Monthly Auction Clearance Rates

Year on year comparison for monthly auction clearance rates demonstrate the market is behaving consistently with the year before when it comes to clearances. The jury continues to be out in Brisbane on whether it is an auction-driven market, but we can see that clearances hover around the 40th percentile.

Monthly Auction Sold Houses 16/17

Monthly Auction Sold Houses 15/16

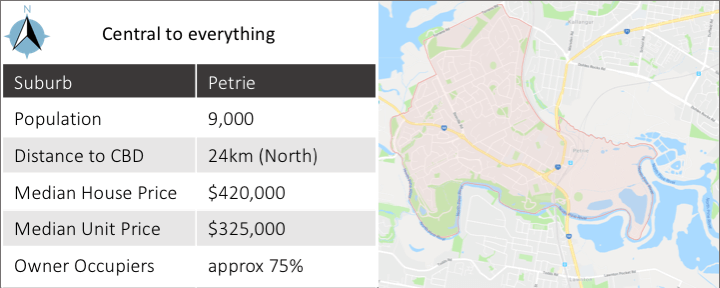

Petrie - "Central to everything, lifestyle aplenty"

Snapshot

Overview

Petrie is 24 km (15 minutes) north of Brisbane on the Western side of the M1. The local residents of about 9000 proudly enjoy all that it is has to offer. Surrounded by the North Pine Dam, Lake Kurwongbah and the North Pine River there are endless recreational activities on offer. Petrie offers proximity to the CBD but the feel of country living.

Streets off the main road offer a range of housing options from quaint cottages to larger modern homes. The shopping village provides convenient shopping with a major supermarket, newsagent, post office, fast food and speciality stores. Petrie is well connected with Petrie Train Station and easy access to arterial and main roads. With a number of schooling options in and around Petrie, it offers a great lifestyle for families.

Petrie is certainly going to benefit from the redevelopment of the old Petrie paper mill into a university precinct, with the University of the Sunshine Coast at its core. The state government has fast-tracked the project after declaring it a priority development area, and it is expected to be up and running by 2020.

Already established Petrie residents who are benefiting from the recent upsurge in values and who are looking to move, are crossing the motorway to the eastern side of the M1 to the Redcliffe Peninsula. The Redcliffe Peninsula is more fashionable but more expensive. Savvy Investors and Upsizers are taking advantage and scooping up the properties left behind.

Future proposed developments to the railways and the Petrie bypass will when complete take additional traffic away from Petrie in peak times and further enhance this suburb as a great place to live.

This largely owner occupier town (76.1% in 2011) has a lot to offer and is definitely worth a second look in 2018.

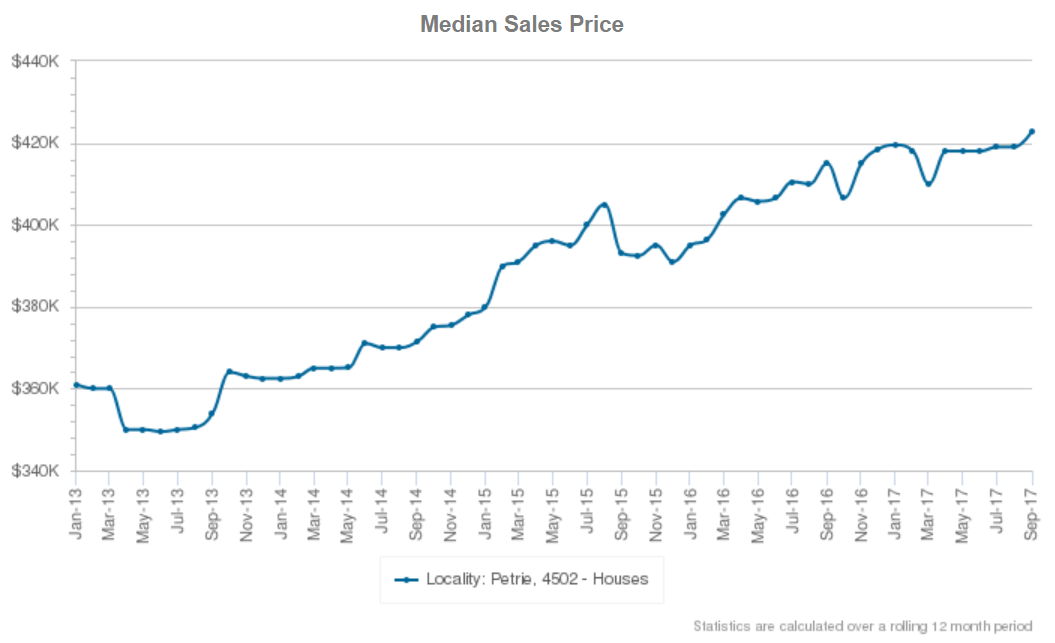

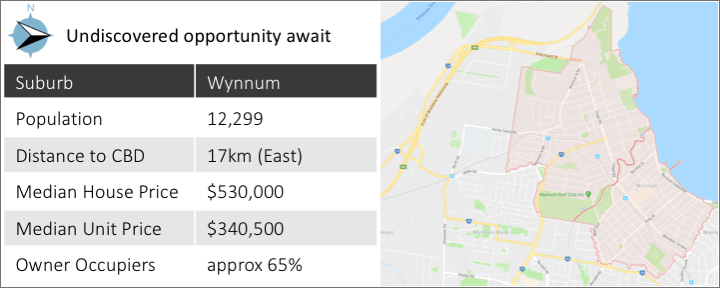

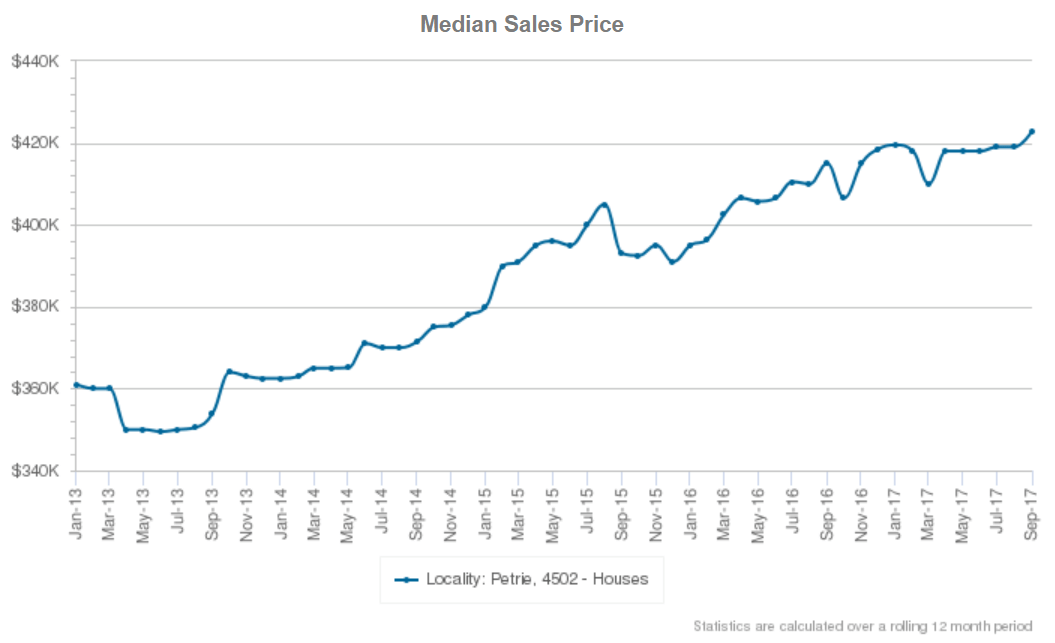

Pricing

Currently, the median sales price of houses in the area is $420,000 and $325,000 for units.

Trend in Growth for Houses

Trend in Growth for Units

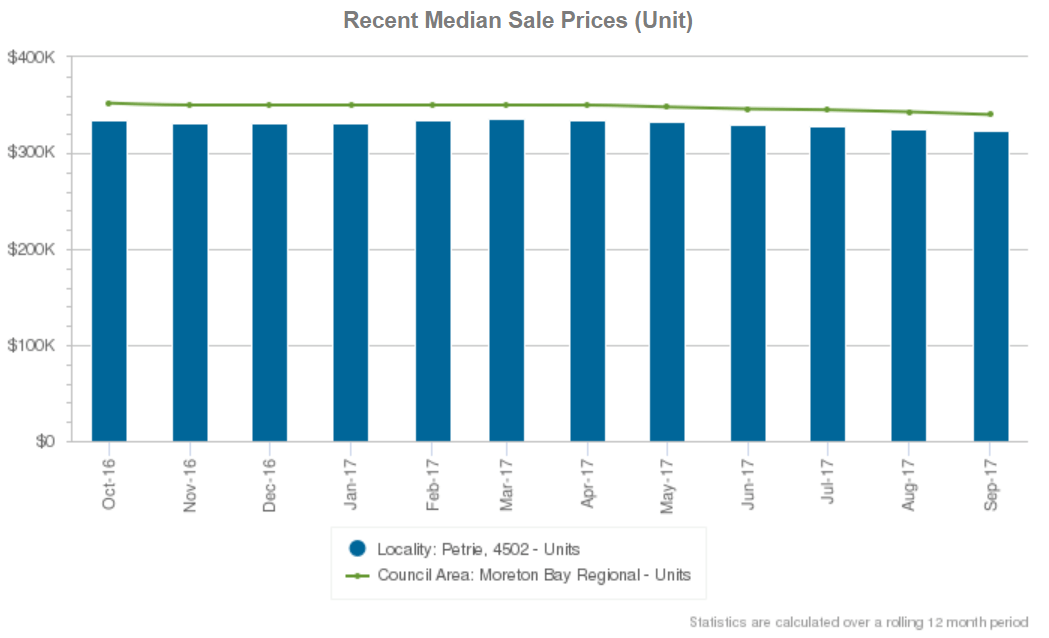

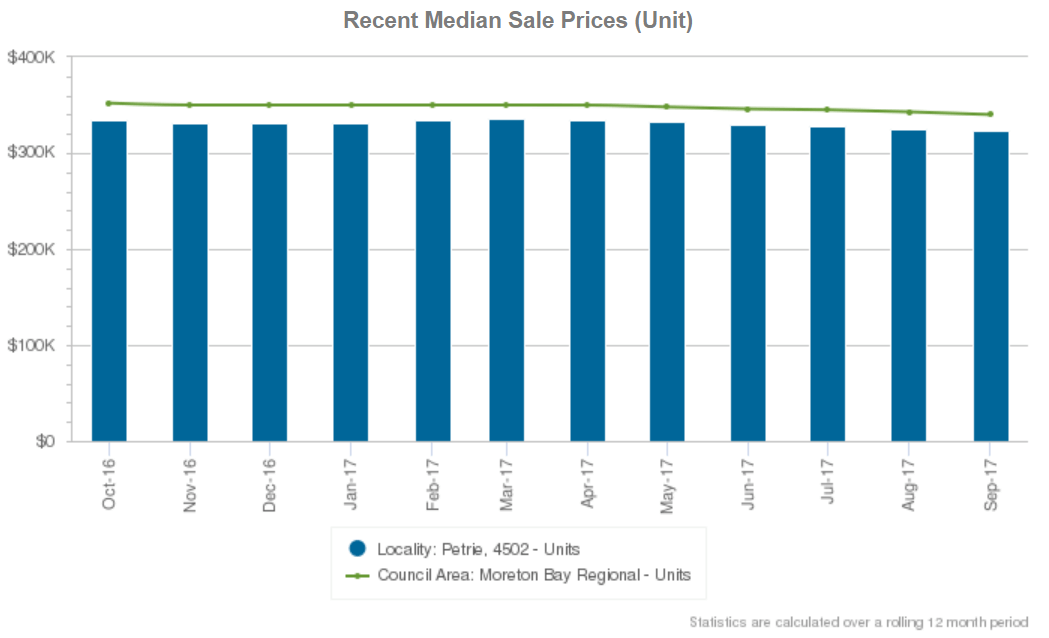

Wynnum - "Undiscovered opportunity awaits"

Snapshot

Overview

Wynnum a suburb waiting quietly in the wings for its opportunity to shine. Wynnum has long been off the radar for a lot of investors but at only 17km east of the CBD and on the coastline it has more than most to offer residents and investors.

The waterfront a major highlight brings locals and visitors to it for a BBQ, picnic or walk by the bay. There are great parks (9) for the kids, including a water park and a heritage listed wading pool that’s over 120m long with modern day water filtering and cleaning equipment.

Offering an easy commute to the CBD from one of Wynnums’s 3 train station (40 mins) or via major roads (40mins), including the M1 Gateway (35mins) there significant infrastructure already in place to help people move around.

Wynnum’s town centre has an abundance of supermarkets, speciality shops, coffee shops and fish and chips to take your pick from. The nearby shopping plaza boasts 3 major stores, Woolworths, Coles and Kmart and over 60 speciality stores offerings goods, services and food.

With public and private schools, great sporting facilities there is plenty of opportunity for families

With approximately 11,000 people living and the majority of them being owner-occupiers (65%) in Wynnum there is a lot on offer. And unbelievably the fact that you secure property for under $550K that offers coastal living with a quick commute to town it is amazing this town has not taken off yet.

Pricing

The current median price for houses is $530,000 and units $340,500

Trends in Growth for Houses

Trends in Growth for Units

by Stephen McGee

Queensland State Manager

0488 501 170 or email me

Market Overview

Good stock is moving quickly and there is a substantial amount of competition for these properties. Adelaide has seen an increase of interest by investors which is largely due to the fact properties are more affordable for the mum and dad investors and offering higher rental yields.

The tightening of regulations by APRA and the ATO have made Adelaide an attractive alternative to the more traditionally expensive cities of Melbourne and Sydney. Any increase in interest rates or holding cost does not have the same impact in this more affordable market.

Demands continues for established dwelling on approximately 700 sqm within 10 kms of the CBD. Savvy buyers are scooping up older properties that can be rented now but room for development in the future.

Adelaide is getting quite a bit of news time and is a great location to invest in for the future.

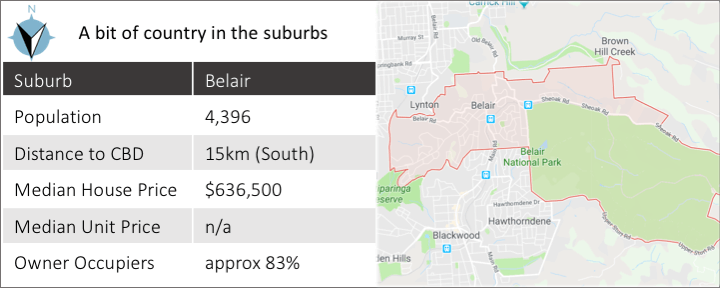

Belair - "A bit of country in the suburbs"

Snapshot

Overview

What’s not to like about a suburb residing in the Mount Lofty Ranges in the Adelaide Hills? The Adelaide Hills are a region world-famous for its winemaking and is one of Australia’s cooler wine regions on the mainland. There are numerous wineries and cellar doors waiting to be explored and sampled!

Adelaide Hills is made up of multiple suburbs, but we believe the suburb to watch is Belair. Belair is a pretty town with stunning views and offers a bit of the country in the suburbs. Belair is 15 kilometres south of Adelaide and has a population of 4,396 and has parks covering nearly 67% of the total area.

Belair offers close proximity to natural wildlife with the Belair National Park at your back door. The National Park is a very popular location and has everything to offer from feeding ducks, cycling, walking, horse riding, enjoying the native flora/fauna, having barbecues and playing social games of tennis, football, soccer and ‘backyard’ cricket. Belair is also a very popular area for mountain bikers. There are bike trails not just in the National Park but throughout Belair, and steep tracks down the hills face to railway stations on the Belair line, which terminates adjacent to the National Park. Oh and if that isn’t enough the Belair Country Club hosts an 18-hole public golf course adjacent to the National Park!

The town has a number of lovely shops and restaurants, Belair Primary School is situated in town, and Scotch College (a private co-educational school) is only a 10-minute drive away in Mitcham and other options are close by.

Belair has a number of grand and stately homes, many with stunning views back across the plains of Adelaide and to the sea. Whilst many of the larger stately and modern mansions are heading and sometimes exceeding the magic $1m mark incredible value can still be found with older and smaller brick or timber framers.

The combination of lifestyle and proximity to the city makes this a superb place to live, so if a slightly cooler winter and a few windy roads don’t bother you there is endless opportunity in Belair.

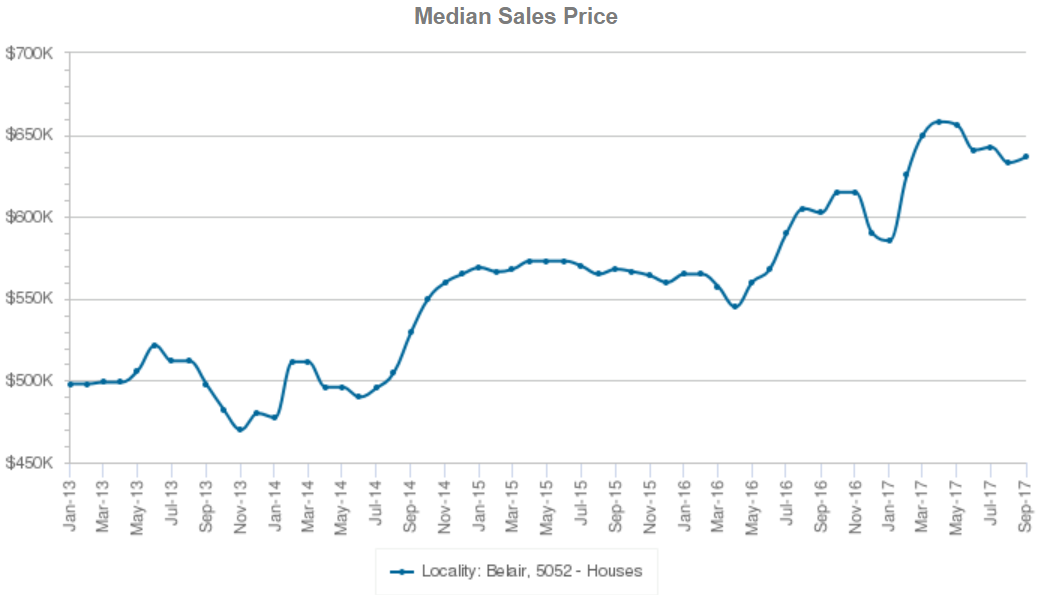

Pricing

Currently, the median sales price of houses in the area is $636,500. There are only 23 units in Belair and not enough data to report on the median price of units.

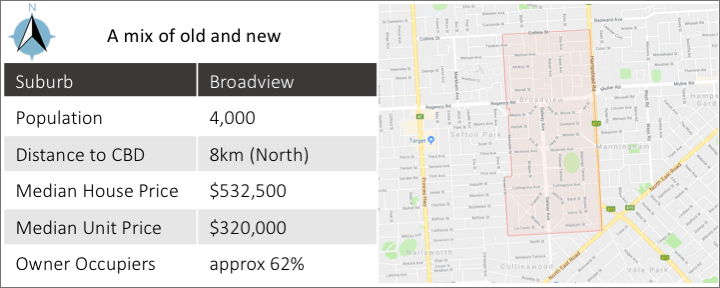

Broadview - "A mix of old and new"

Snapshot

Overview

Broadview at only 5.8km offers a delightful mix of old and new homes. With approximately 4000 local residents, the suburb is relatively small and 62% of property ownership resides with owner occupies.

What Broadview offers is true suburbia, tree-lined streets, old homes and with proximity to the CBD with those looking for a bit more entertainment.

It offers a great family lifestyle. There are parks, playground and its own local primary school. It has local childcare options for pre-schoolers and nearby secondary colleges. It is a short commute to the University of Adelaide for families with older children. There is a lovely park in the area called Broadview Oval. It is very green and is excellent for playing a match of footy, soccer, cricket, and more.

Broadview is a mix of traditional bungalows and modern larger homes. Broadview is modernising and if done correctly and some of its character retained it is a good thing.

Broadview is becoming more multi-cultural and its restaurants and takeaway venues are benefiting from the introduction of different cuisines. Cinemas and cafes are available in North Adelaide or drive a few more minutes to the Adelaide Market on the weekend. It’s a leisurely 45-minute walk to Melbourne Street or the Zoo. If you like the bus, they run frequently through the area. Cycling is so easy, too. The Norwood Parade and the Prospect precinct is also a 10 minutes drive.

Traffic can become a little congested around some of the main roads surrounding Broadview as commuters head in and out North Adelaide and the CBD. However, Broadview is peaceful and family friendly and perfectly positioned – a 20-minute drive to the beach and 20 minutes to the CBD in peak (10 mins off-peak)

Price

Currently, the median sales price of houses in the area is $532,500.

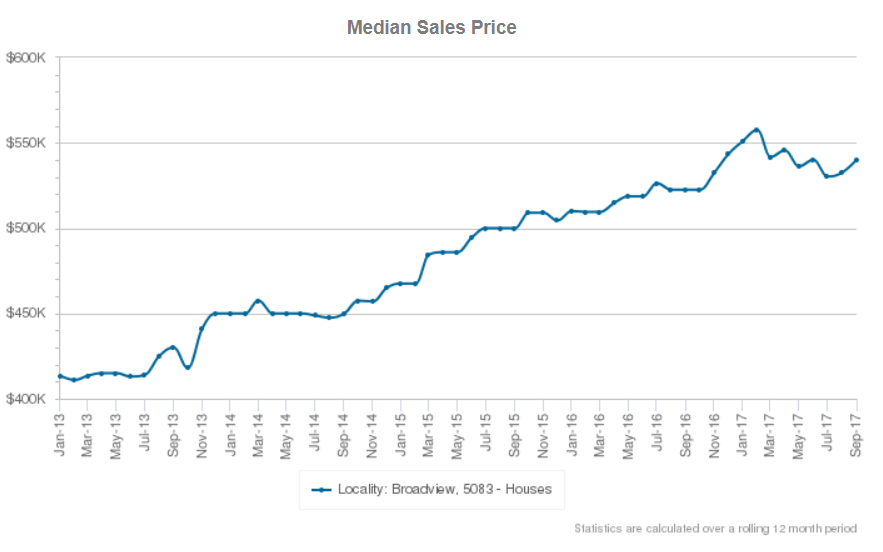

Trend in House Pricing Growth

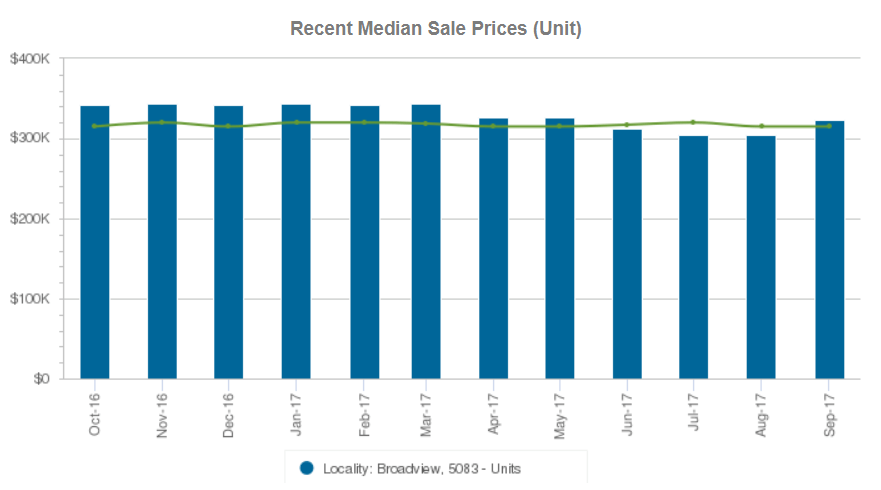

Trend in Unit Pricing Growth

by Katherine Skinner

Buyers Agent and Senior Property Manager

0438 729 631 or email me

Market Overview

Economists have declared Australia’s world-record housing boom is over and we have seen a cooling in the market over the past few months, however buyer competition for properties with unique features in sought after areas remains strong. Quarter 4, people were out enjoying the summertime weather, the festive season was upon us and everyone was looking forward to the Christmas break. There were plenty of listings on the market, with vendors aiming to shift their properties before Christmas.

Interestingly, the Christmas break can represent a good time to scoop up a property, with fewer buyers in the market there is often more stock to choose from and less competition, while others are holidaying our Buyers’ Agents were on the ground sourcing great property opportunities!

The media has consistently reported a slowing market in Sydney. True, the Sydney market has slowed, the heat that fuelled 75% growth in property prices over the past 4 years has subsided. Property prices have not been soaring above auction reserves and a higher proportion of properties are being passed in at auction or sold prior, the declining clearance rates reflect this.

Yes, we are finally seeing stagnated prices, and while there is a sentiment that prices will fall the reality is that prices have just stopped growing at a rapid rate.

Although the market has cooled we are continuing to see properties in the typically sought after areas sell for reasonable prices and savvy investors are turning their focus to finding renovation opportunities to reap the benefits of better depreciation and lower holding costs.

In this market there is a higher number of listings and sales volume which in turn means greater value and more realistic prices for buyers. Buyers are looking for more value and being more selective about where they put their money, they certainly have more choice however quality properties in top suburbs will continue to achieve strong prices.

Last quarter we focused on new regulations and legislative changes designed to slow property growth. The holding cost of an investment property has increased but buyers need to think outside the square to create wealth from property investment in the next Sydney property cycle. Working with a trusted team of advisors is pivotal to a property investor’s success and we recommend connecting with a good Buyers Agent, Financial Planner, Mortgage Broker and Quantity Surveyor to ensure you grow a quality portfolio and get the best return on your investment.

Traditionally the Christmas break is quiet in real estate and we anticipate there will be little movement in the market until mid-January to early February, but that’s not to say the right property isn’t out there at this time of year!

Brookvale, Northern Beaches - "The Sands are Changing"

Snapshot

Overview

Brookvale is located 16km north-east of the Sydney CBD on the Northern Beaches. It is a smaller suburb with a population of approximately 3,161.

Brookvale is well serviced by a bus line which offers express buses to the CBD, a service to all beaches along the peninsula as well as the upper North Shore suburbs. This suburb has traditionally had an industrial focus with a large proportion of commercial real estate and small to medium businesses occupying the land. The suburb borders Freshwater, Allambie Heights and North Manly which are highly sought after suburbs and Brookvale is starting to reap the ripple effect in property prices as buyers who can’t afford to live closer to the beach move into the area.

The Northern Beaches Council has released the Brookvale Vision and Structure Plan in 2017 which showcases the long-awaited future development of the suburb. A focus on retaining the area’s industrial base and employment opportunities alongside increasing residential dwellings has been implemented. Below is a summary of some of the proposed changes to the area:

- Transport to and from Brookvale will be enhanced including a shuttle bus service within Brookvale and the connection of Condamine Street to the Northern Beaches Tunnel.

- Brookvale Oval, home to the Manly Sea Eagles, has been earmarked for rejuvenation including the development of an activity precinct around the oval.

- An increase in commercial land use east of Pittwater Road and development of affordable housing for local and commuter employees.

- The creation of a new town centre and network of cafes and restaurants.

- An increase in higher density living near the town centre.

Brookvale is home to the largest Westfield shopping precinct on the Northern Beaches and is located between two major regional roads making access to and from the Peninsula easy.

The future vision for Brookvale will see this suburb transformed into a new Northern Beaches hub where people who are looking for a more affordable beaches lifestyle will be able to work and live within close proximity to upgraded amenities and the Sydney CBD so watch this space!

The majority (61%) of properties are units, followed by houses (18%) and semi-detached townhouses (18%).

The population is almost evenly split between couples with no children (44%) and families (39%). A high proportion of people are aged 20-39 years.

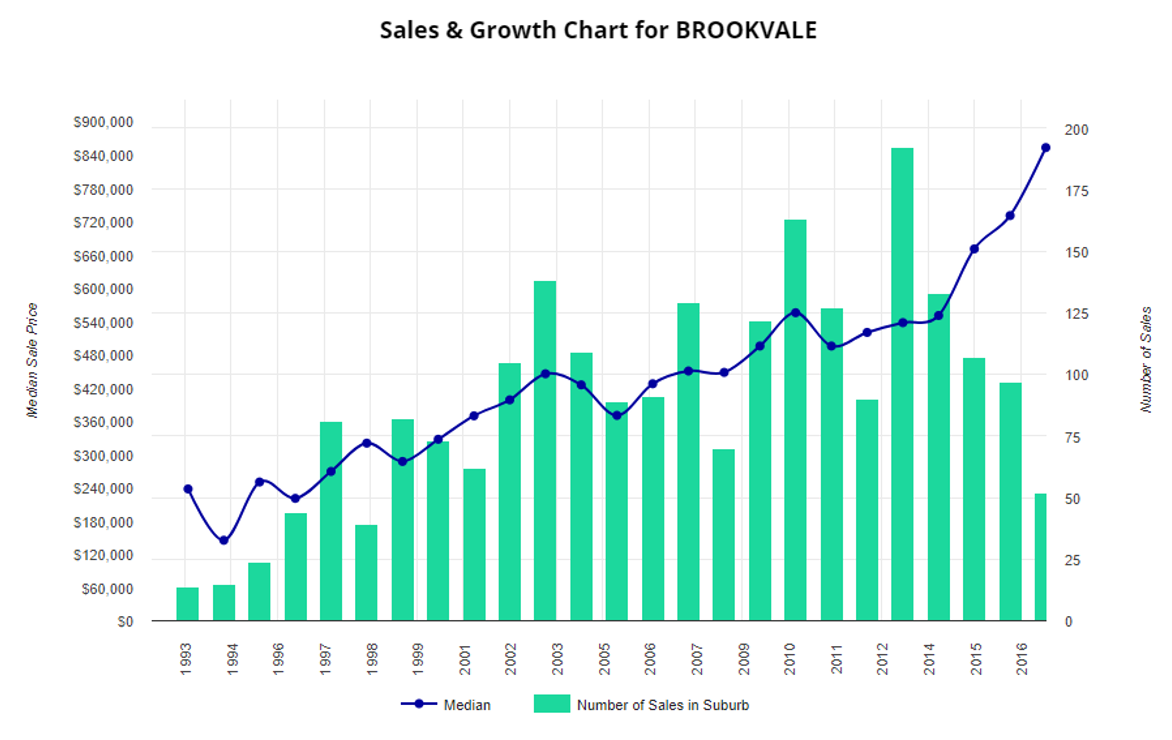

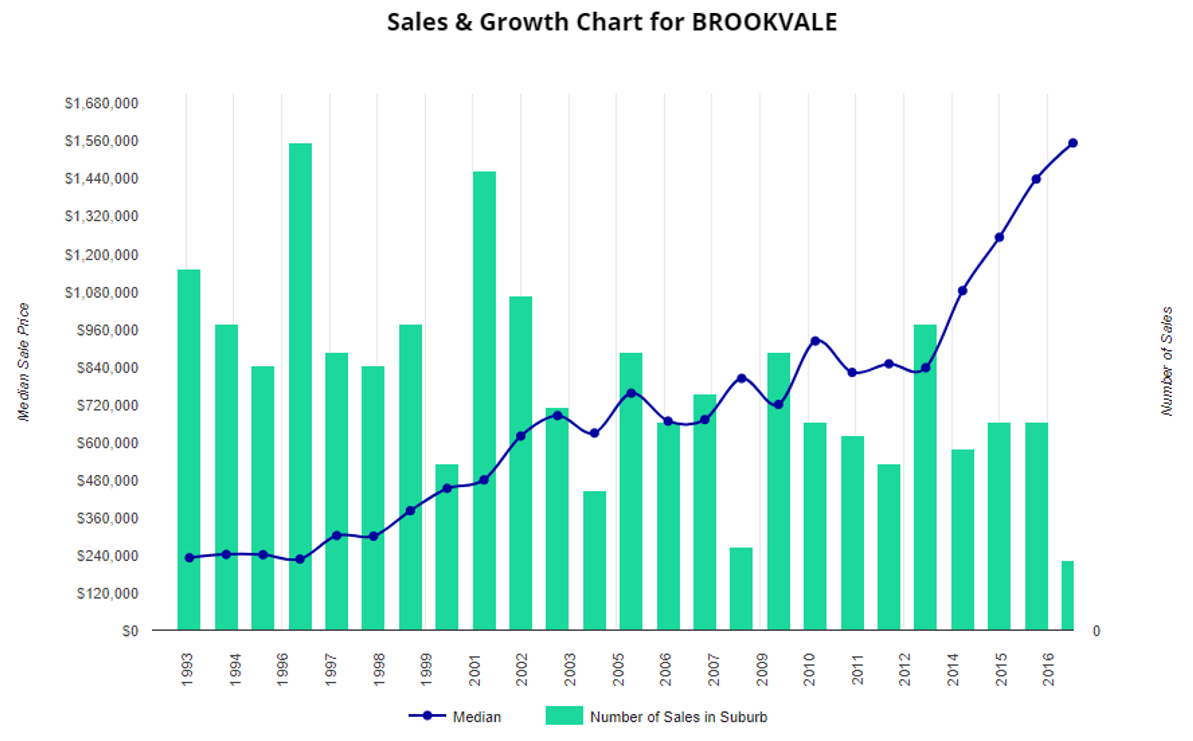

Pricing

The median house price in Brookvale is $1,550,000 and for a unit $852,500 making this an affordable suburb for first home buyers wanting to live close to the beach.

Current Median Pricing 2017

Trends in Growth for Units

Trends in Growth for Houses

Purchase Example

Excellent entry level buying for a young couple or young family or a great rental return for an investor, only 15 years old and recently renovated this oversized two-storey townhouse with a tranquil outdoor living area is a stone’s throw from Warringah Mall and CBD bus stops. Within 10 minutes’ drive from Manly and the beach, this private townhouse makes a quality investment. Last purchased in 2009 for $580,000 and recently sold for $1,200,000. Low strata levies and rental return of $900pw – $950pw. View the agent listing here.

Dulwich Hill, Inner West - "Inner suburb lifestyle"

Snapshot

Overview

Dulwich Hill is located 11km south-west of the Sydney CBD. It is a large Inner West suburb with a population of approximately 13,000 and is bordered by Marrickville, Hurlstone Park and Lewisham.

Dulwich Hill is easily accessed within 30 minutes by train and 40 minutes by bus from the Sydney CBD. The suburb is also connected to Lilyfield, Darling Harbour and the CBD by light rail. Only 5kms from Sydney University and a short drive to shops, cafes and restaurants in Marrickville and Newtown, Dulwich Hill is a popular suburb for students and inner-city families.

Part of the Sydney Metro City and Southwest Project, Dulwich Hill will benefit from the new T3 Bankstown train line that is being upgraded between Sydenham and Bankstown. This area will also benefit from enhanced neighbourhood precincts, a renewed town centre and improved open spaces and community services.

Properties in Dulwich Hill range from newly developed units to heritage style Victorian terraces and pose great opportunities for buyers looking for a character home to renovate or a set and forget unit investment.

The majority (54%) of properties are units, followed by houses (31%) and terrace houses (11%).

Dulwich Hill has a high proportion of people aged between 20-59 years with 42% of these being young families and 39% are couples without children.

Pricing

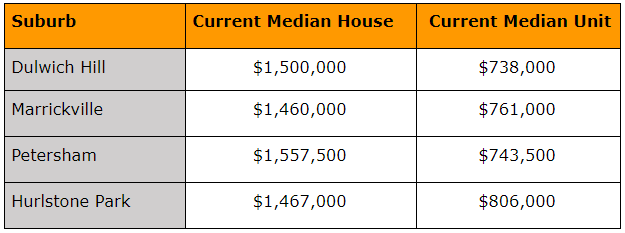

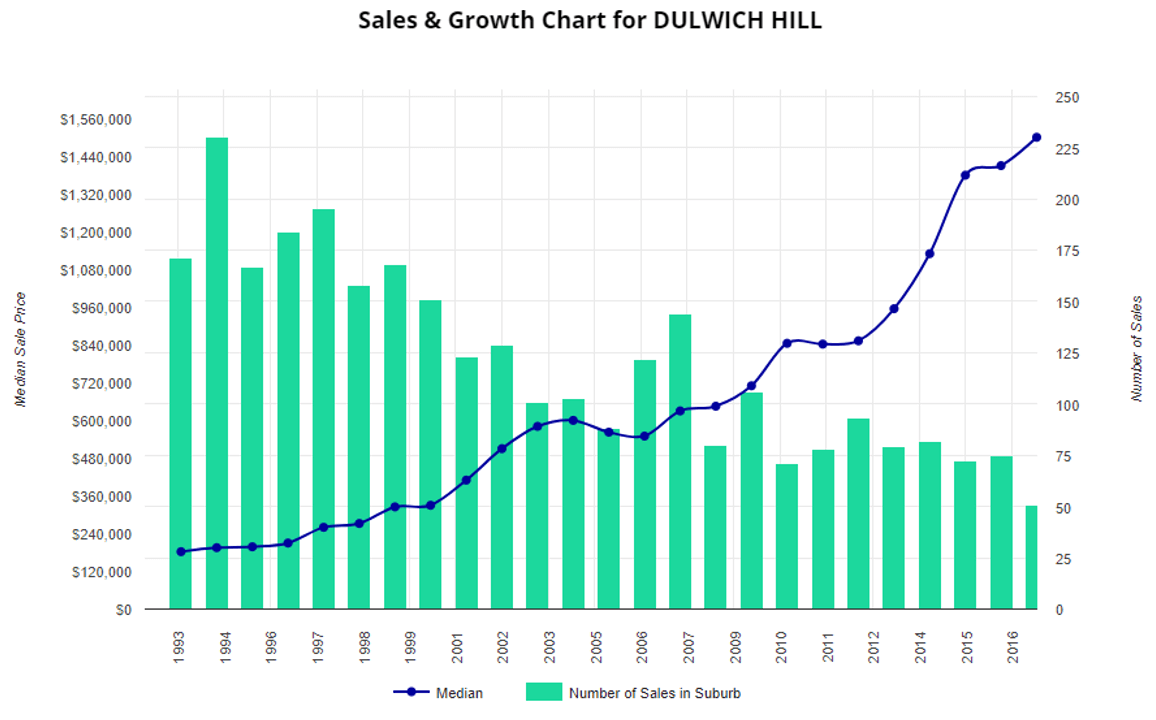

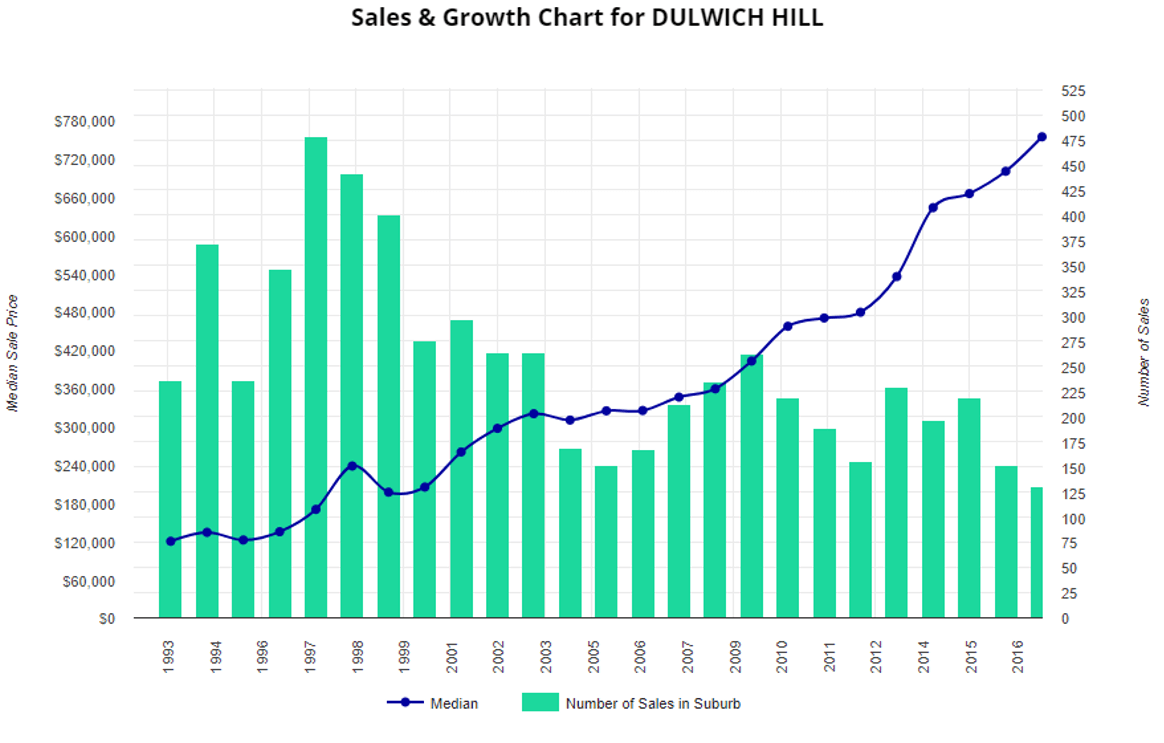

The median price of a house in Dulwich Hill is $1,500,000 and for a unit $738,000. Houses have grown 12.8% and units 7.7% in the past year. Year on year growth for the past 10 years has been 9.3% for houses and 8.3% for units.

Current Median Pricing 2017

Trend in Growth for Houses

Trend in Growth for Units

Purchase Example

In an excellent location on a sought after street within walking distance to shops, cafes and restaurants, this nicely renovated unit ticks all the boxes for a quality long term investment. It has 2 balconies, an internal laundry and lock up garage and is in a well built, low maintenance 1970s block of 18 units. This is an ideal unit for a young couple or students looking for quality accommodation. Last purchased in 2006 for $335,000. Click here to view the agent listing.

by Simone Luxford

State Manager New South Wales

0429 039 558 or email me

We have prepared four case studies on properties we purchased in Q4 meeting our different client’s needs. It is so important when you are buying property that you have a clear vision of what you want to achieve. And you may come to a Buyers Advocate knowing what that is or it might be something that you can build together.

For example, one of our case studies focuses on parents buying a unit for their children to live in whilst studying in Brisbane. That was a clear vision but after speaking to NPB Queensland they added that their unit could be used to build wealth for the family in the future.

Buy, Rent, Sell! Watch it come to fruition (VIC)

Client type: Investor

NPB Purchase Price 2013: $482,000

NPB Sold Price 2017: $745,000

Rent: 1890 pcm Yield: 4.7%

Agent Listing: http://bit.ly/NPBPascoeVale

Property: Contemporary, three bedroom, two bathroom single level townhouse with 2 car lock up garage. In a peaceful rear position with excellent natural light,

Case Studies don’t get much better than this – we purchased, managed and sold our client’s property. In 4.5 years the properties value grew 36%.

In 2013 our client, Craig and Tamara wanted to buy a low maintenance townhouse in a high growth area. We scoured the market, and presented several ideas through our client property portal and organised inspections for the short-listed properties. Once we found the perfect match in Pascoe Vale we negotiated the purchase and secured the property under our valuation.

We offered Craig and Tamara our property management service, which they gladly took up. We managed the property for 5 years and secured two lots of terrific tenants through our vetting service.

To fund renovations for their Sydney home Craig and Tamara decided to sell the townhouse. Without hesitation, Craig and Tamara took advantage of our free vendor advocacy service. We shortlisted and presented real estate agents, negotiated the commission and managed the sale of the property which for our interstate clients made the process significantly easier and less stressful.

The property was sold in October 2017 and achieved an outstanding result, $263,000 above its original purchase price in 2013. Our clients were wrapped but instead of taking our word for it please read the testimonial below detailing their experience with a full-service firm:

To: Antony Bucello <[email protected]>

Date: Wed, 1 Nov 2017 09:49:35 +1100

Subject: ANTONY BUCELLO & National Property Buyers experience

To all those who are looking to purchase an owner occupied or investment property,

My wife, Tamara & I, were looking to purchase an investment property, in Melbourne, in late 2012. We lived in Sunbury & wanted a property that we could see reasonably easily. A friend of ours, Chris Howitt (Mortgage Choice) recommended National Property Buyers. It was then we met Antony Bucello, a buyers advocate for NPB. We realised immediately that we were going to be in good hands!

From the very beginning Antony made us feel welcome; “call me Ant, all my friends do” he said. Ant asked us to think about the type of property that we were looking for, explained the costs involved, the benefits of using NPB, what to look for in a property (location, growth, etc), strategies when wanting to make an offer on a property and so forth. Once Ant had an idea on the type of property we were looking for he went to work. We looked at several properties, had reports on each of them, discussed what we liked & disliked. Ant was always available to talk to. We had our own personal portal, set up by NPB, where we could place our search properties, queries, etc. into. After several property inspections we came upon a townhouse in

Pascoe Vale. We loved it—it had everything that we wanted in an investment property. Ant organised a personal inspection, as well as routine ones. He then discussed our strategy in making an offer, giving us his expert opinion in the value of the property. The outcome was that we bought the property and only $1K off Ant’s opinion!

Ant then advised us that NPB also manage properties, in case we wanted to use them. We thought that was a good idea—NPB had been great so far. Ant introduced us to Rob and the team. The managing of our property was very good. We had two lots of terrific tenants throughout our 5 years of owning our investment property. All potential tenants were thoroughly screened and their references checked. NPB then offered their recommendations on which tenant would be the best but the final decision was always ours.

Communications between tenant & NPB and NPB & us were always good. If there was ever a query or request, it was dealt with quickly & with little fuss. Rent was always paid, routine inspections were done comprehensively & a detailed report given. Ivonne has been managing our property for the last 12-18 months and she has been great!

Recently Tamara & I have wanted to do some renovations to our place in Sydney—moved back to Sydney a couple of years ago with work & to be closer to family. So we decided to sell our investment property. We were sad to sell as it was a terrific property & investment. Once again we used Ant & the NPB team. This time Ant was our seller advocate. Ant was, once again, a thorough professional. He sought real estate agents, negotiated commission, outlined a selling plan of attack & discussed a selling price range.

Although Ant did all this, we still had the ‘final say’ in matters. Communications were always open and readily available. Tamara & I felt so lucky to have Ant helping us. On 28th October 2017 we sold our property in Pascoe Vale for a great price—more than we had ever hoped for!

Antony, Rob, Ivonne & the rest of the team at National Property Buyers (NPB)—thank you so much for being a part of our investment journey! You definitely made this experience a rewarding & profitable one! The fee that NPB charge for their services was such a good investment in itself as it saved us a lot on the purchase and made us more in the selling! Ant & the team made this whole 5 year experience feel like ‘a walk in the park.’

Tamara & I can’t thank Ant and everyone at National Property Buyers enough for their services. We would have no hesitation in recommending Antony Bucello & the team at National Property Buyers to anyone looking to purchase or sell an owner occupied or investment property, or to simply manage an investment property!

Sincerely,

Craig M****

Helping our clients buy their dream coastal home (NSW)

Address: 6 Carawa Street

Purchase Price: $1,150,000

Agent Listing: http://bit.ly/NPBUminaBeach

Client type and budget: Our client was looking for their dream family home by the seaside and identified Umina Beach as their preferred area to live. Umina offers community beachside living with great cafes, restaurants and shops and is only 50 minutes from Sydney’s Central Station on an express train.

This family needed to be within walking distance of the town centre and the beach. A 5 bedroom brick house on a level block of land at least 700sqm in size were essential criteria to their brief. The land had to be large enough to fit a granny flat, a workshop and a veggie garden.

Property: A recently renovated 5 bedroom, 2 bathroom home on 708sqms of level land with a lock up garage, side access and room for 5 cars!

Solution: This property ticked all our client’s buying criteria and was identified as the perfect family home in the popular area of South Umina. It is within 10 minutes walking distance to the town centre, 6 minutes to Umina Beach and 3 minutes to the Peninsula Recreation Area. Only an 8 minute drive to Woy Woy train station makes visiting friends in Sydney easy!

Purchase: Successfully purchased and contracts exchanged on a Sunday ahead of another committed buyer. While the other buyer was at a wedding we were negotiating offer and acceptance on the Saturday evening with the condition that we exchanged contracts on Sunday. What a great outcome for our clients!

Moving States and Homes, how to do it the easy way! (SA)

Purchase Price: $585,000

Agent Listing: http://bit.ly/NPBBelair

Client type and budget: Our client planned on relocating to Adelaide in 2018 and wanted to secure a home in the popular Adelaide hills.

This young family wanted a comfortable, modern home with light-filled rooms which can quite often be difficult to find in these suburbs due to the large trees and surrounds. They also needed a relatively flat, usable area suitable for young children to safely play and explore.

Property: A 4 bedroom, 2 bathroom home flooded with natural light and providing the family with a versatile floor plan which will grow over the years with their family.

Solution: This property ticked all our client’s buying criteria and was identified as the perfect family home in the popular area of Belair. The property is a short walk to Belair Train Station and a variety of schools and shops.

Purchase: Successfully purchased after a large number people through the first open and other offers placed on the property. We had this in our sights well before it went to market and managed to pre-qualify it at a private viewing prior to it being open to the public. Our client then attended the open from Sydney before placing an offer. The purchase was made $25,000 under our clients maximum budget and the conditions of our offer were appealing to the vendor – we knew that the vendor has already purchased another property and wanted to move ASAP so our quick 30-day settlement was enough to get the deal over the line.

Buying with your heart but thinking with your head (QLD)

Property Type: Established Unit, 3 bedroom

Purchase Price: $425,00

Scenario: A Professional Couple from WA were referred to us by their financial planner.

They have 2 children attending University in Brisbane and both have been residing in Student assisted accommodation for a while but had long realized that it is not the best suited for them and did not please the parents also.

The mother had made numerous trips to Brisbane to search for a suitable unit for them to buy for their children, but was finding it a daunting and stressful task. The unit had to be large enough to accommodate the son, daughter and a 3rd flatmate as well as offering ample living and study area.

As the son was following in his father’s footsteps and forging a career in the medical industry it had to be close to the Royal Brisbane Hospital in Herston and the daughter had to be within easy commute to Queensland University of Technology (QUT) at St Lucia.

Engagement:

After an initial telephone conference with the wife and a face to face meeting in Brisbane on her next visit the clients agreed to our advice of acquiring an older style 2 bedroom unit (which tend to be larger than new) and has potential to create that 3rd bedroom or if timing on market is right we can find an existing 3 bedroom unit.

We were also mindful that the unit had to satisfy all of NPB’s investment grade criteria as well as the client’s criteria – as when the children had outlived the unit’s purpose the clients needed to know that it would either easily rent or sell at a profit. They toured around the suburbs we suggested and they liked the feel and logistics of them so we were all ready to start.

They approved a budget of $430k but a contingency of $450k if really needed.

Acquisition:

After 3 weeks searching and 2 potential matches (that the mother had found online) written off, we came across a unit in Ashgrove.

Situated in a 1980`s style two-storey brick block of 6- it was built to last. This unit was on the 1st floor and located in the front corner and not adjacent to any other units offering great privacy as well as elevations.

The unit has 3 bedrooms, 1 bathroom and a great size living area and a study nook. The unit had been renovated by the owner occupiers – who needed to upsize with an additional child on the way – and was ready to move in.

This unit ticked all the boxes:

- Location

- Size

- Bedroom

- Renovated

- Transport

- Close to shops

The unit was about to be taken off the market and was in fact no longer advertised online – it had been online for 90 days and the owners had decided to refinance and keep the unit. This could either work in our favour or it could lessen the motivation of the owners to sell.

The unit was originally advertised online for offers over $450k and had been so for the duration of the listing, however our valuation was no higher than $430k.

After arranging inspections for both the children and the mother we received a strong approval to commence negotiations. After opening the negotiations at early 400k and after 2 weeks of negotiations we reached $425k at which point both parties agreed and signed off on the contract.

The unit sailed through the valuation and building inspections and after a 30-day contract, settlement was reached.

A very happy husband and wife and ecstatic children. Some more happy clients.

Our 3 local Property Managers provide an overview of the rental market in their home states including what’s hot and what’s not, what tenants want and the vacancy rate in the local market.

Melbourne Rental Overview

REIV Q4 Average Vacancy Rate 2.2% – NPB Q4 Average Vacancy Rate 1.6%

Demand for rentals remained strong in Q4. Traditionally leasing usually slows down leading up to the festive season. However, at NBP our November lettings were racing at high speed. Leasing was occurring in a shorter span of time, after a few opens or even one.

We experienced an increase in lease breaks, none for 6 months then having 6 in a month. Mainly due to people securing new jobs in the new year or purchasing a property and settling before Christmas.

Tenants are looking for mods cons in rental properties:

- Internet Availability (NBN, ADSL)

- Working from home options

- Cooling – This time of year Cooling is paramount, it is the first item tenants look for. If it is split-system is it the bedrooms, or multi-levels is upstairs where it is hottest

Landlords are feeling a little unsettled by pending changes to the Residential Tenancies Act. In November 2014, the Victorian Government announced a comprehensive review into the Residential Tenancies Act 1997 ‘(RTA)’. The review, due for completion in 2018, is aimed to amend the RTA to meet the expectations of current and future landlords and tenants in Victoria.

The changes are to increase rights of the tenants but there are concerns by some that is taking the rights of the property owners. More can be read here on the proposed changes here.

A full list of the proposed reforms can be found at Fairer Safer Housing

Main areas for reform include:

- extend the scope of the RTA to include long-term tenancies beyond five years duration;

- require disclosure of landlord details in tenancy agreements;

- create more rights for tenants, such as making ‘no pets’ clauses unenforceable if it’s unreasonable, mandate 7 days’ notice for landlord visits and premises to have reasonable security measures;

- require rental agreements to set out the liability for removal of fixtures and maintenance requirements;

- extend conciliation services to landlords as well as tenants; and

- require VCAT to hear all applications within 2 business days.

On a final note, the REIV has released an online petition calling on the Andrews’ Government to amend proposed changes to Victoria’s rental laws. Landlords can complete the Rentfair is Unfair petition.

Average Weekly Rents for Melbourne

by Ivonne Di Perna

Brisbane Rental Overview

Brisbane Q4 Average Vacancy Rate 3% – NPB Q4 Average Vacancy Rate 2%

The Brisbane rental market for this quarter has still been slow with many suburbs having an oversupply of advertised rental properties available. This has resulted in many agents reducing rental rates and owners/developers offering incentives to potential tenants. This has given tenants a wider choice of properties if they are not committed to a particular suburb.

In this quarter, we have found that houses are having higher enquiries than units overall. The option of a yard, pets and their own space makes this more appealing – especially for families. Pets in any property are generating more rental enquiries, and the tenants usually stay for longer terms.

NPB vacancy rate for the quarter is 2% – while the Brisbane rate is 3%. Our commitment to getting the enquiries through the property as soon as possible has been a major factor in achieving this figure and limiting the vacancy time for our owners.

Heading into 2018, historically this is the busiest time for rentals with many moving to Brisbane and wanting to get settled before the school and Uni year commences. Properties within popular school catchment areas, and with close public transport options are the most popular during this period.

by Tracey Farrell

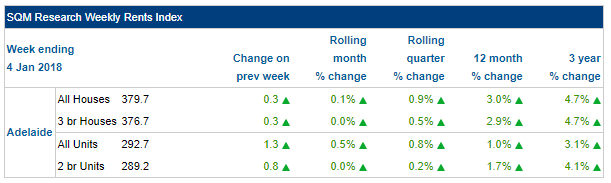

Adelaide Rental Overview

Adelaide Q4 Average Vacancy Rate 1.9% – NPB Q4 Average Vacancy Rate 0.01%

The rental market in Adelaide is continuing to show good strength in growth and with low vacancy rates, quality stock doesn’t last on the market for long at all. During the summer period we always see the rental market move very quickly with spikes in rental prices – we always recommend our landlords coincides renewals for tenancies during the summer period to make the most of this type of performance year on year.

Savvy tenants are seeking good quality stock. Modern facilities, outdoor entertaining areas with small easy to maintain yards, good storage and NBN ready are big-ticket items for many prospective tenants at the moment.

We have been finding that all properties across the board if priced correctly are moving quickly with a good quantity of high calibre prospective tenants around most of the time. Over the past 3 months NPB properties have leased, on average, within 2.5 weeks of being advertised, one property had 50 people turn up and let in a day.

Adelaide vacancy rates are sitting steady at 1.9%.

by Katherine Skinner