Q1 2022 Property Market Insights Report

Quarter 1, 2022

Market Overview

I feel like I am stuck on repeat but the Adelaide property market is hot, hot, hot!

There has been a slight cooling in the market, mostly of steam not price, however in saying that we are currently experiencing some of the highest auction clearance rates in the country.

The Adelaide auction market is growing. The number of scheduled auctions each week is sitting near the 200 mark and the clearance rate is consistently in the 90th percentile. Whilst private sale is still the preferred method (around 300 each week) vendors are definitely taking advantage of buyers either fighting it out on auction day or nervous buyers putting in high pre-auction offers. A win-win for vendors.

Last quarter we talked about 6 factors contributing to Adelaide’s stellar price growth:

- Affordable median price

- Low levels of stock

- Low interest rates

- Tight rental market

- Adelaide’s growing reputation

- Opportunities for every budget

Let’s see what impact they had in Quarter 1, 2022.

1. Affordable Median Price

We still have one of the most affordable median dwelling values of Australia’s capital cities. The current median dwelling value is $602,717 up from $569,882 at the end of last year. When you compare that to Sydney’s $1.116m, Canberra’s $932k and Melbourne’s $805k that’s a substantial difference.

Last year Adelaide experienced the highest growth rate in 5 years when the median dwelling value went up a whopping 23.2% in 2021.

2. Low Stock Levels

In good news for buyers more advertised stock is being added to the market and this is instilling a little bit of calm. Potential buyers aren’t quite as frazzled and have a chance to draw breath before their desired property is snapped out from underneath them.

However, according to CoreLogic advertised stock levels in Adelaide remain more than 40% below the previous five-year average levels and around 20% to 25% down a year ago. So maybe don’t take too many breaths!

3. Low Interest Rates

There has been growing nervousness around interest rates. For most of last year, it was predicted that interest rates would not rise until late 2023/early 2024, however, there is a growing belief that interest rates will start to rise in the new financial year in a response to a faster than anticipated increase in inflation.

Whilst we expect this is true, we do not expect that there will be a sudden large increase in interest rates but a moderate increase over time.

The Commonwealth Bank of Australia is predicting an initial increase to 0.25 per cent (in June), rising to 1.25 per cent in early 2023.

4. Tight Rental Market

The rental market continues to out-perform itself! At 0.7% we have one of the lowest rental vacancies rates in Australia. Investment property owners sitting on quality homes have the pick of the bunch when it comes to quality tenants.

Rental yields are also sitting high at around 4% to 5% for many purchases our investors make.

Sustained vacancies rates this low do make it a difficult market for tenants to find, apply and get approved for properties. For property owners though high rental yield and low to no vacancy period are on the cards.

5. & 6. Opportunities and Growing Reputation

We have seen an influx of interstate residents relocating to Adelaide or interstate investors buying in Adelaide in the last year or so. They are attracted to the amazing lifestyle options we have on offer coupled with our affordable buy-in price.

Whether it be city, beach or tree there is truly something for every home buyer and almost every budget.

And as a reminder (and because we like to gloat) we were named the third most liveable city in the world in the Global Liveability Index last year 2021. Six of the top ten cities in the March 2021 survey were in New Zealand or Australia, and we were the highest-ranked Australian city!

7. A bonus one for this quarter

The Federal Budget was announced on the 29th of March and there are a few expansions and continuations of existing schemes that will mean more people may be able to buy a home sooner.

- Expanding the first home buyers scheme (up to 35,000 place).

- Creating a new regional housing scheme to encourage construction in regional areas.

- Money to extend the Family Home Guarantee scheme which is aimed at helping single parents.

Some experts have warned that some of these schemes won’t do anything to solve housing affordability as it introduces (or brings forwards) additional buyers to markets that may already have low supply. I believe at an individual level these might provide relief or opportunity (if used wisely) for people but probably won’t have a huge impact on the macro level in South Australia.

Looking forward

We see no reason for the Adelaide market to slow down. Our affordable buy-in price becomes even more attractive to investors (especially interstate) if interest rates rise.

Our rental market is incredibly tight, and we do not expect any changes to this soon. It could potentially get tighter with international migrants and students starting to return to our shores.

And my last tip is whilst there has been a little calming of the waters it is so important to have your finger on the pulse. You need to know the market you’re looking in, and have realistic expectations about what can be achieved with your budget. Do not waste time looking in a market/location that is beyond your means, whilst you are doing this property prices are probably moving north in the market you should be looking in!

Suburb to Watch

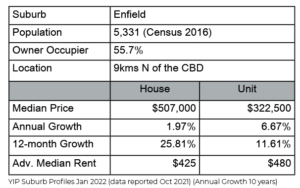

Enfield - Family Friendly Neighbourhood

Overview

Enfield is an inner northern suburb approximately 9kms from the CBD. The older area has spent the last few years redeveloping and attracting new residents. Locals all rave about how peaceful and family-friendly it is and that it provides easy access to everything you need.

Shopping

Enfield has a small shopping centre that includes an IGA, a bakery, a post office, a salon and a barber. Enfield is well serviced by NorthPark Shopping Centre, Regency Plaza and Sefton Plaza which are located in the neighbouring suburbs of Prospect and Sefton Park. These facilities which are a short drive away provide access to all the shops, restaurants and cafes you need.

Education

Enfield has two government schools; Enfield Primary and Enfield High School (Roma Mitchell Secondary College. There is also a CoEd Catholic Primary School and a Girls Catholic High School within its borders. There is an excellent kindergarten in the middle of the suburb.

Local families love the local schools and kindergarten but there are more options with excellent schools in the surrounding areas.

Transport

Enfield is located only a short 15-minute drive from the city and has multiple bus routes running around the suburb. These bus routes will get you to the northern suburbs, the CBD and various shopping destinations.

Parks and Recreation

Enfield has a few parks and recreation areas that offer a combination of playgrounds, sitting areas, walking trails, a tennis court and large green spaces. It is also home to half of Enfield Memorial Park which very much looks like a beautifully maintained public park.

And in only 20 minutes you could be enjoying some of the most popular metropolitan beaches of Glenelg and Henley.

What can you buy there?

Enfield is a combination of older homes on large blocks and new homes. It is quickly developing and for those seeking capital growth, the best buys are the older homes that are suitable for redevelopment. However, the new builds represent great buying if you are a family and looking for something that is ready to be moved in and enjoyed.

As Enfield develops it becomes more and more popular with families, especially ones that want some space and have been priced out of more expensive inner suburbs like Prospect, Collinswood and St Peters.

Purchase Example

Set on a large 740sqm (approximate) block conveniently located close to a variety of amenities including schools, shops and parks. Updated 3 bedroom entertainer with light-filled living spaces. Huge covered deck and spacious backyard with large workshop and the quintessential cubby house.

Interstate investors seeks capital growth and healthy rental yield.

by Katherine Skinner

Director

Katherine Skinner began her career in property over a decade ago in Melbourne working in Buyer’s Advocacy and Property Management. Returning to her hometown of Adelaide in 2009, Katherine quickly established a reputation as an exceptionally thorough and diligent practitioner, providing outstanding customer service coupled with a calm and positive attitude while working with some of Adelaide’s most highly regarded agencies. Katherine was named the REISA Buyers Agent of the Year 3 years running, a REIA National Awards Finalist twice, a Women in Real Estate Finalist and is the current South Australia representative for REBAA.

0438 729 631 or email Katherine