Q2 2022 Property Market Insights Report

Quarter 2, 2022

Market Overview

It’s been a busy quarter. And I don’t just mean the number of clients we have helped.

This quarter saw the first interest rate rise since November 2010. And then there was the second as the RBA attempts to combat rising inflation. We started the quarter at the historic low of 0.1% and finished it at 0.85%. Whilst this is still a relatively low-interest rate, consumer confidence is dipping as this coupled with the rising cost of living is making people redo their household budgets and recalculate what their borrowing capacity is.

The Adelaide property market holds a unique position to weather this increasing storm though.

Of Australia’s 8 capital cities Adelaide has one of the most affordable median dwelling values at $628,744. Cities like Sydney, Melbourne, Canberra and even Brisbane all have high median dwelling values. Adelaide’s relative affordability has made it more appealing to buy in for interstate investors or relocators. In conjunction with its high growth rates, in the past year, Adelaide dwelling values increased 26.1%, a record high growth rate according to Corelogic’s June monthly housing chart pack. So now we have a more affordable buy-in price coupled with significant capital growth.

What about the rental market?

Not many people want to buy an investment property and have it sit empty. And that is very unlikely to happen in Adelaide. Adelaide currently has the lowest vacancy rate across Australia’s capital cities. According to SQM’s May 2022 figures the national vacancy rate sits at 1.00% whilst Adelaide’s is 0.3%.

The rental market is becoming increasingly tight across Australia and in some areas is in crisis. We are being inundated with prospective tenants at inspections and receiving multiple applications for properties. We can take the pick of the bunch for our rental providers (landlords).

Adelaide’s rental yields are also attractive to investors. Due to the demand on properties and the boom in prices in the last year or 2 asking rents are creeping up. Our client’s investment properties are enjoying rental yields of around 4% to 5% for houses and 5 to 6% for units.

What about homeowners?

As a local Adelaide resident, I might be a bit one-eyed, but Adelaide has so much to offer its residents. And our reputation is growing amongst Australians, in the last year, we helped our highest number of clients wishing to relocate to this amazing city.

Just scraping the top of what’s on offer – we have an unparalleled calendar of festivals taking place throughout the year for people to enjoy and explore in this beautiful city. They don’t call us the festival city for no reason!

We have 30kms of stunning coastline to explore and at only twenty minutes from the city, you can enjoy the wide sandy beaches and water sports any day of the week.

And then there are the hills and the winery regions. South Australia is home to 18 wine regions and is officially named a Great Wine Capital of the World. There truly is something for everyone.

What’s happening on the ground?

Auctions clearance rates have been incredibly high this quarter. Frequently sitting in the 90th percentile. These high numbers reflect a vendor’s (sellers) market. Towards the end of the quarter clearance rates softened and sat in the 70th per centile which is closer to a balanced market. Private sales remained high through the quarter hovering around the 300 mark each week.

In Adelaide, where housing conditions remain quite strong, advertised stock levels are still -16.9% lower than last year and almost -40% below the five-year average.

In CoreLogic’s June Home Value index report, they reported that advertised stock levels are still -16.9% lower than last year and almost -40% below the five-year average in Adelaide. Demand exceeding supply will also keep property prices high. In the sub-$600k market it is still as competitive as ever with results far exceeding expectations still week on week however we have noticed a softening in the higher-end market.

Oh and there was a Federal Election this quarter too.

On the 21st of May this quarter the federal election was held and we saw the party in power change from the Liberals to Labour. During an election year around campaign time, the property market can quieten a little as people wait to see whose policy mandates may become legislated. However, with none of the major parties spruiking any changes to negative gearing or capital gains it was more about how the government might help struggling property buyers. The Labour Party pitched the “Help to Buy” scheme which could see 10,000 Australians each year have up to 40% of the cost of buying their home tipped in by the government (for a share of ownership!) The scheme is yet to be legislated but more detail on its proposal can be read here:

Looking forward

The Adelaide property market remains in very good shape compared to some other states. The value for money aspect and attractive rental yields means Adelaide will continue to attract both local and interstate investors for some time to come.

Buyer confidence is still high across all metropolitan markets, even with rising interest rates. This is great for home buyers and investors who can and should have strong confidence in putting their money into a stable asset that will continue to appreciate year on year.

With rental yields still holding strong, combined with high demand, and investors looking for long-term options, we continue to see value buying in our local market.

While we expect the market will stabilise over the remainder of the year, we don’t foresee a huge decline in the market. There will be changes in the coming months where property growth may stall for a period of time. We are starting to see more off-market and pre-market options available for consideration as Vendors also feel the pressure of the swinging market and are more open to getting a quiet deal done before market.

Now is the time to be making educated purchases and to be prepared well in advance by knowing exactly how your cashflow situation sits and allowing for the inevitable future interest rate increases we are going to see for the remainder of 2022.

Suburb to Watch

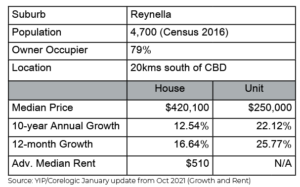

Reynella - Get everywhere you need to go

Overview

Reynella is located 20km south of the CBD in the City of Onkaparinga. Interestingly nearly half of the suburb is public land with an old quarry! Bounded by a river on one side locals love to explore the walking trails whilst enjoying views of the beautiful southern coastline.

The public land is divided from the rest of the suburb by the Southern Expressway, once across it, you are suddenly in a residential suburb with nearly 2000 homes.

Reynella is becoming increasingly popular with families. There is a number of quality schools nearby including Woodcroft College, Prescott College and Reynella South Primary School.

The best shopping is located just on its southern border at Southgate Plaza Shopping Centre. The plaza is anchored by Coles, Target and Aldi and offers 38 stores to shop in. If you prefer your shopping centres bigger you can head to the Westfield Marion by car in about 15 minutes. The Westfield Marion is the largest shopping complex in Adelaide with 342 stores.

The suburb has several parks and ovals. Including the popular Robertson Street Reserve. You can take your pick of activity here basketball (half court), tennis, or the playground. The best part is the bike/scooter track which has working traffic lights and road signs so the kids can practice their road rules.

The major drawcard of Reynella is its easy access to the city, the southern beaches, Mclaren Vale Wine region and Flinders Medical Centre and University. There are a number of bus routes through Reynella that will take you to the city, the plaza or the Westfield Marion. The Southern Expressway by car will have you in town in about 30 minutes. Really, you can get everywhere you need to go easily.

The types of properties you are likely to find in Reynella are 1970s brick homes on 600 to 800 squares. Some larger blocks have been subdivided and townhouses built on them.

There really are no bad pockets of Reynella, however, just check for traffic noise if you are looking closer to the Southern Expressway. Read the below case study on a great investment property in Reynella we recently purchased for our client.

Interstate investors seeks balanced investment and we find one off-market

by Katherine Skinner

Director

Katherine Skinner began her career in property over a decade ago in Melbourne working in Buyer’s Advocacy and Property Management. Returning to her hometown of Adelaide in 2009, Katherine quickly established a reputation as an exceptionally thorough and diligent practitioner, providing outstanding customer service coupled with a calm and positive attitude while working with some of Adelaide’s most highly regarded agencies. Katherine was named the REISA Buyers Agent of the Year 3 years running, a REIA National Awards Finalist twice, a Women in Real Estate Finalist and is the current South Australia representative for REBAA.

0438 729 631 or email Katherine