Market Overview

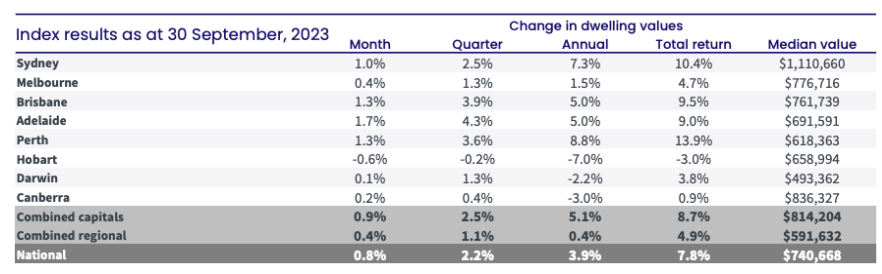

Nationally home values continue to rise. CoreLogic reported in the three months to the end of September that home values rose 2.2%, with Adelaide achieving 4.3% growth. Which was the highest capital gain for the quarter across the capital cities!

The housing market continues to defy expectations even with rising interest rates and cost of living increases we did not experience a significant drop in housing values. In fact, Adelaide only experienced a mild dip of 1.7% during its short-lived downturn.

Consumer confidence seems to be increasing as we near the expected peak of interest rates and many economists are predicting interest rates will go down at some point in 2024. At a business level, we have experienced an uptick in enquiry across the board from local and interstate buyers, whether they are seeking a new place to call home or an investment. In fact, in Quarter 3 we bought more property for our clients than Quarter 1 and Quarter 2 combined.

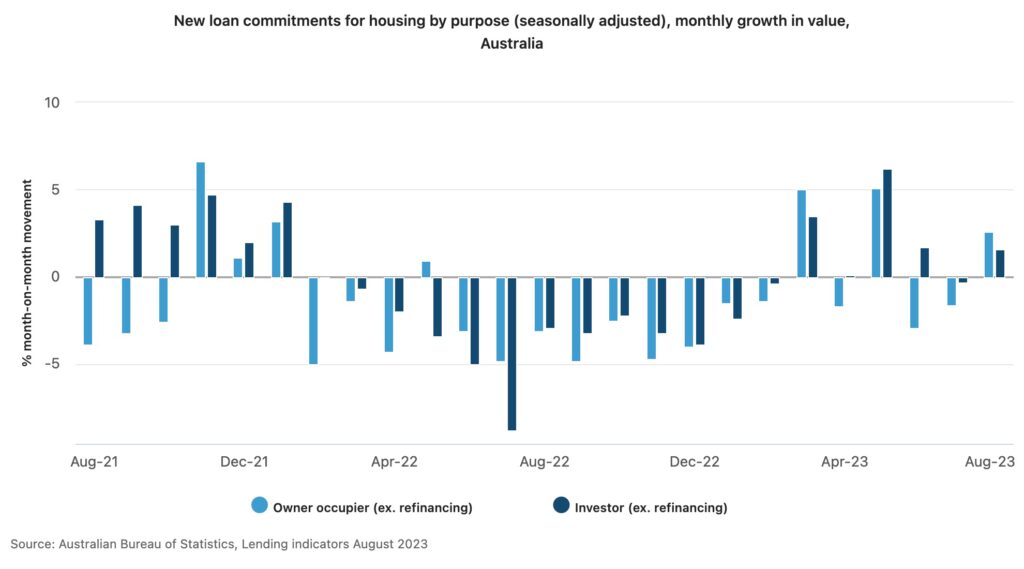

This increase in activity can also be demonstrated in data released by the ABS on new borrower-accepted loan commitments. In the 22/23 fiscal year, the ABS reported that new loan commitments fell 14.1% overall, however, in 2023 we have experienced multiple months where the value of new loan commitments has increased, meaning increased activity in the real estate sector.

Now let’s take a closer look at why Adelaide’s quarterly growth is outpacing the other capital cities.

Why does Adelaide continue to outperform other capital cities?

There are several contributing factors to Adelaide’s high performance in the current market and 7 of the leading reasons are below:

- Affordability – It is hard to believe that at the end of 2019, before COVID and before the cost-of-living rises the median dwelling value in Adelaide was around $440,000 and now at the end of 2023 Adelaide’s median dwelling value is $691,591. And this still makes us more affordable compared to most of our sister capital cities including Sydney, Canberra, Melbourne, and Brisbane. We have become somewhat of a mecca for interstate investors who are priced out of their own local markets and see value in our great city. Our average investment purchase price for our clients in 2023 was $628,888.

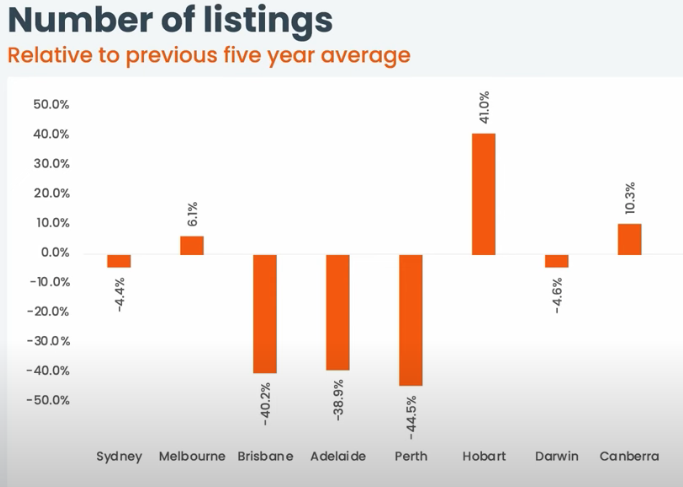

- Low Supply Levels – Now it cannot be denied that one of the key reasons for price growth in the market, is low supply. Tim Lawless from CoreLogic reported “ advertised supply levels have remained persistently and substantially below average.” in Adelaide. There was an uptick of new supply leading in the Spring season, but demand for quality homes and A-grade investment properties continued to outpace supply.

- Low Vacancy Rates- In every report this year we have said Australia is in the midst of a rental crisis. Unfortunately, there is no quick fix, limited new housing supply, plus population growth has sent many state governments scrambling to produce solutions to combat the issue. Throughout the year Adelaide had the lowest or second lowest vacancy rates across the capital cities. According to SQM Research our current vacancy rate is 0.5%, however somewhere between 2 and 3% is a sustainable rental market. Whilst low vacancy rates make it a tough time for tenants, it cannot be denied that it is benefitting investors.

- High Rental Yields – The knock-on effect of low vacancy rates is that weekly rents have been on the rise. According to SQM Research Adelaide weekly rents have increased by 15.3% in the last 12 months! Adelaide investors are enjoying above average rental yields. Our average rental yield achieved for our clients is 4.7% with many enjoying over 5% and we typically only buy houses for our investor clients. This is in comparison to SQM Research’s reported average rental yield for houses at 3.8%. These high rental yields have the advantage of reducing monthly outgoings for investors and safeguarding them from the impact of interest rate rises.

- Properties for every budget – Adelaide and its surrounding suburbs offer genuine opportunities for buyers in most budget ranges. The market is bigger than people give it credit for, in the last 18 months we have purchased properties in 95 different suburbs. During 2023 we bought investment properties for our clients ranging from $394,000 to $1,360,000 and for homeowners from $367,000 to $3,025,000! So, whether your budget is small or large there is the perfect property for you in Adelaide.

- Cash Rich Buyers – Interstate buyers are still investing heavily in the local Adelaide market, whether they are relocating or investing in our strong but well priced market. Any relocators that have sold property in more expensive capital cities are able to bid aggressively and place high offers which is driving prices up for desirable properties.

- Unbeatable Lifestyle – Adelaide’s reputation as a lifestyle destination is growing rapidly. Whether you want to live near the sea, the hills, or the city there are lifestyle options for everyone. Pristine white beaches and world-class wineries can be reached by car in as little as twenty minutes from the city and we are a city known for its festivals, love of sport and world-class food and wine.

What’s the outlook for 2024?

It is widely predicted that interest rates have neared their peak, with cuts predicted to start in late 2024. This is giving some buyers comfort around being able to accurately calculate the cost of buying a property for the short to medium term and for investors to understand the holding cost of buying a property. However, some people are starting to feel the pinch of cost-of-living increases and are tightening their belts.

In some cities, less so in Adelaide, there has been a softening across price growth even though most cities continue to show growth.

We expect demand to continue to outpace supply for all of 2024, if not at least the first 6 months and for that to continue to deliver growth to our city as there are still a healthy number of prospective purchasers looking to get into the market. We think family-friendly homes on largish blocks of land and townhouses in metropolitan areas to continue to perform well, especially if minimal renovations are required. Agents are indicating that they are seeing strong appraisal and listing numbers, earlier than usual so far this month where the market is usually quiet until after Australia Day.

The rental market will remain tight, with projected positive population growth in 2024 contributing to demand. There is speculation that the rapid growth in rents will slow due to the rising cost of living which means tenants cannot simply not afford to pay more.

We cannot wait to help all our clients, new and old, and are expecting to secure some amazing buys for them.

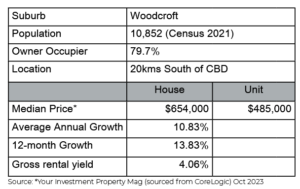

Suburb to Watch | Woodcroft - "Southern Family Living"

Overview

Woodcroft is 20 kilometres south of the CBD and located at the base of the Adelaide Hills. It is a family-friendly suburb that has really come into its own which is why the majority of households are couples with children.

The suburb is approximately 7 kilometres in size and 36% of it is covered in parkland. It boasts amazing schools, an abundance of parks, local shops, medical services, gyms sporting grounds, public transport and multiple shopping centres nearby.

It is a well-located suburb and provides easy access to a number of great locations including:

- 30 minutes to the CBD by car, 55 minutes by bus on the Southern Expressway

- 11 minutes to Westfield Marion Shopping Centre (the largest mall in Adelaide)

- 15 minutes to Flinders University and Medical Centre

- 22 minutes to Mclaren Vale (home to world-class wines and culinary delights)

- 15 minutes to the closest beaches.

Woodcroft offers quite a wide variety of housing options from entry-level 3-bedroom homes through to high-end prestigious, more expensive properties and even smaller acreages based in the foothills. There are some great estates such as Glenloth which is a highly sought-after and peaceful pocket.

It’s not just the families enjoying Woodcroft, young professionals and retirees are also moving here or choosing to stay. Affordable, peaceful and well-located and favoured by owner-occupiers it is definitely worth a look for the home buyer or investor.

Purchase Example

4 Bedrooms | 2 Bath | 8 Car | 930m2 | $910,000

4 Bedrooms | 2 Bath | 8 Car | 930m2 | $910,000

Spacious 4 bedroom home on 930m2 in a quiet cul-de-sac. Ideally located close to all amenities and only minutes away with the following at your fingertips, Woodcroft Town Centre Shops, includes Woolworths, Bunnings , Woodcroft Primary, Emmaus Catholic School, Woodcroft College, Reynella East College and a short drive to Prescott College.

by Katherine Skinner

Director

Katherine Skinner began her career in property over a decade ago in Melbourne working in Buyer’s Advocacy and Property Management. Returning to her hometown of Adelaide in 2009, Katherine quickly established a reputation as an exceptionally thorough and diligent practitioner, providing outstanding customer service coupled with a calm and positive attitude while working with some of Adelaide’s most highly regarded agencies. Katherine was named the REISA Buyers Agent of the Year 3 years running, a REIA National Awards Finalist twice, a Women in Real Estate Finalist.

0438 729 631 or email Katherine