South Australia Market Update

$802,075

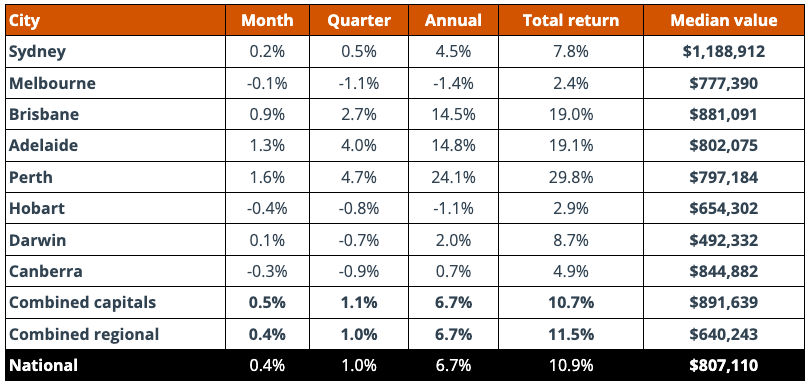

Let’s just pause on that number – the median dwelling value of property in Adelaide in Q3 2024.

In Q3 2020 the median dwelling value in Adelaide was $449,803, so in 4 shorts years it has almost doubled.

Source: CoreLogic October 2024

So, is there still value in the Adelaide market? Absolutely. Is it harder to find? Unfortunately, yes. This market requires patience and persistence to find and secure your ideal property.

Let’s have a closer look at the state of play in the Adelaide market and what factors are contributing to its continuing high growth and popularity amongst interstate and local buyers alike.

Why does Adelaide continue to outperform other capital cities?

There are several contributing factors to Adelaide’s high performance in the current market and 8 of the leading reasons are below

- Strong Capital Growth – Nationally values continue to rise though the rate of growth has slowed across the regions and cities. However, Adelaide outperformed every capital city bar one for growth at 4.0% in the September quarter. In the last 12 months Adelaide has enjoyed 14.8% growth. And this is in a market hampered by high interest rates and cost of living pressures. This growth is very attractive to investors when other capital cities growth has stopped or gone backwards.

- Affordability – With a median dwelling value of over $800,000 it is getting harder to wave the affordability flag I must admit. However, this year the average purchase price for our investor clients is $646,000 with the lowest purchase price at $444,500.

- Properties for every budget – Let’s dive a little deeper into the cost of buying in Adelaide. The local market is bigger than people give it credit for we have purchased properties in over 100 suburbs in the last two years for clients. In Q3 we have purchased investment properties from $485,000 to $917,000. And for homeowners, from $570,00 for a First Home Buyer to $1,212,000 for interstate relocator. So, whilst the median price is trending upward there still opportunities for different buyer types and budgets in Adelaide.

- Low Supply Levels – Listing numbers are starting to track a little higher in the busy Spring season. However, stocks levels continue to remain low compared to previous periods. Corelogic reports that advertised stock levels are 12% lower than a year ago and 33% below the previous 5-year average. Despite this there has been 16.6% increase in the volume of sales in the past 12 months! Low supply levels are putting sellers in the driver’s seat and placing pressure on prospective purchasers to find and then secure their preferred property. My advice in this market is to be patient and but persistent. Have a clear criterion and budget and really consider what your “must-haves” are.

- Low Vacancy Rates- It cannot be denied that whilst low vacancy rates are bad for tenants, they are good for investors/landlords. And it appears, unfortunately, that Adelaide has held onto to the mantle for the lowest vacancy rates across the capital cities at 0.6%. The capital cities vacancy rates range from 0.6% (Adelaide) to 2.1%(Canberra). A healthy vacancy rate is around 3 per cent and at 0.6% vacancy rate the Adelaide rental market is in crisis for tenants. We know firsthand from rental open for inspections and receiving large numbers of applications how hard it is out there for tenants. On the flip side it does mean for landlords they are experiencing little to no vacancy times between leases.

- High Rental Yields – The knock-on effect of low vacancy rates is that weekly rents have been on the rise. In the last 12 months Adelaide rents have increased by 12.2% for houses and 16.5% for units. Our investor clients are achieving an average rental yield of 4.6% so far this year, which is above Australia’s (3.8%) and Adelaide’s (3.9%) gross rental yields reported by CoreLogic. The advantage of higher rental yields is the reduction of monthly outgoings for investors and potentially a positively geared or cashflow property. Nationally rental growth has started to slow down and according to CoreLogic this is due to a reduction in net overseas migration and affordability pressures on renters.

- Cash Rich Buyers – Interstate buyers are still investing heavily in the local Adelaide market, whether they are relocating or investing in our high performing market. Any relocators that have sold property in more expensive capital cities are able to bid aggressively and place higher offers which is driving prices up for desirable properties.

- Unbeatable Lifestyle – Adelaide’s reputation as a lifestyle destination is growing rapidly. Whether you want to live near the sea, the hills, or the city there are lifestyle options for everyone. Pristine white beaches and world-class wineries can be reached by car in as little as twenty minutes from the city and we are a city known for its festivals, love of sport and world-class food and wine.

Looking forward

For the remainder of the year, we expect demand to outweigh supply. However, cost of living pressures are restricting buyers spending so we expect growth to continue but at a more measured rate.

The consensus is the next move in interest rates is that they will come down. The Commonwealth Bank has one of the earliest predictions for the first rate cut occurring in December.

It will be very interesting to see what happens when interest rates do start to come down whilst we have such low stock levels, it could place even more pressure on our market.

The rental market will remain tight, unfortunately there are no quick fixes here. We do expect the rate of rental growth to slow as past price increases are absorbed by the market and renters just cannot afford to pay more.

We expect to be very busy in this Spring selling season and the lead up to Christmas!

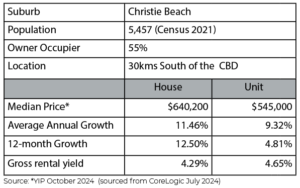

Suburb Review: Christies Beach

Christies Beach is a seaside suburb about a 30-minute drive south of Adelaide. Known for its picturesque coastline which can be viewed extensively from Witton Bluff, which is currently undergoing a $6.7m transformation. The project aims to provide improved access to quality public open space whilst showcasing the scenery, geology, heritage and natural beauty of the area.

Aside from the esplanade and beach is popular Beach Road. Littered with shops, cafes, restaurants, butchers, chemists, doctors, butchers, petrol station and a Coles it really does have everything you need.

Increasingly families are attracted to the suburb with two local primary schools (one government and one public) and easy access to the city by the Southern Expressway.

There are great opportunities for quality developments through subdivision on larger blocks close to the beach. Many will provide sea views with two storey dwellings, which are extremely sought after given the lifestyle it offers while providing accessibility to the CBD as well.

by Katherine Skinner

Director

Katherine Skinner began her career in property over a decade ago in Melbourne working in Buyer’s Advocacy and Property Management. Returning to her hometown of Adelaide in 2009, Katherine quickly established a reputation as an exceptionally thorough and diligent practitioner, providing outstanding customer service coupled with a calm and positive attitude while working with some of Adelaide’s most highly regarded agencies. Katherine was named the REISA Buyer’s Agent of the Year 3 years running, a REIA National Awards Finalist twice, a Women in Real Estate Finalist.

0438 729 631 or email Katherine