Market Overview

If you follow real estate, and if you are reading this report, you obviously do, you will know that national housing values are down for the first time since 2018.

2022 started strongly however once interest rates started to rise and rise quickly in response to the increased cost of living consumer confidence dipped. In January interest rates were 0.10% and by the end of the year 3.10%. People’s willingness or ability to borrow money reduced.

However, Adelaide came out ahead.

According to CoreLogic, 2022 saw a 5.3% drop in national housing values. However, there is a significant difference in the performance of each capital city. The biggest declines were in Sydney (-12.1%) and Melbourne (-8.1%) whereas Adelaide at 10.1% experienced the largest value rise over the year!

Despite the national downturn housing values generally remain well above pre-COVID levels. In fact, according to CoreLogic Adelaide’s housing values remain 42.8% above pre-COVID levels! And just a year ago we reported Adelaide had one of the highest 12-month capital growth rates across Australia’s capital cities at 23.2%.

Now, Adelaide has not been completely immune to the recent market softening, our accelerated growth phase has slowed, and we have just experienced our very first quarterly decline in Adelaide at 0.1%. On the ground we have noticed that open for inspections are slightly less busy and on auction day we are competing against less bidders. At the very start of the year auction clearance rates were high, towards the 90th percentile but now we are hovering around the 65th percentile. This decline in bidders at auction is in large part due to buyers requiring “subject to finance” or “subject to sale” clauses in contracts and not being able to buy under standard auction conditions. It is worthy to note, unlike Sydney or Melbourne Adelaide’s preferred campaign method has always been “private sale.” Usually there are two to three more private sale properties listing than auction.

Why is Adelaide performing so well?

There are several contributing factors to Adelaide’s high performance in a softening market and I recently wrote an article for Australian Property Investment magazine detailing 6 reasons Adelaide and its regions are outperforming other cities and states:

- Affordability – At $649,041 (CoreLogic, December), Adelaide has one of the most affordable median dwelling values of the major capital cities. In fact, the average property purchase price for our investor clients for 2022 is $514,780.00

- Low Vacancy Rates– Australia is in the midst of a rental crisis and nowhere is that more evident than in South Australia. According to CoreLogic, the combined capital cities’ vacancy rate finished the year at 1.2% with Adelaide the lowest at 0.4%.

- High Rental Yields – Our investor clients are achieving average rental yields of 4.9 percent, compared to the combined capital city average of 3.0 percent. High rental yields have the advantage of reducing monthly outgoings for investors and potentially providing positive cash flow. This can make holding onto investment properties easier for everyday Australians especially when the cost of living is increasing.

- Strong Capital Growth – We know in a turbulent market Adelaide just achieved 10.1% annual growth but even better regional South Australia has been the standout for growth conditions over the past year, with values up 17.1%, according to CoreLogic.

- Properties for every budget – Adelaide and its surrounding suburbs offer genuine opportunities for buyers in most budget ranges. Whether your budget is $400,000 to $3 million (or more!) there is the perfect property for you. In fact, check out my suburb review below for a great suburb for investors or home buyers with smaller budgets

- Unbeatable Lifestyle – Adelaide’s reputation as a lifestyle destination is growing rapidly. In 2021, Adelaide was named the third most liveable city in the world in the Global Liveability Index. Whether you want to live near the sea, the hills, or the city there are lifestyle options for everyone.

What’s the outlook for 2023?

South Australia is well-positioned to ride out the softening market.

The year will start quietly as people enjoy the summer holidays and time away from work. Typically, we see a surge in listings from early February through to Easter.

Buyer activity in Adelaide should continue to soak up fresh listings, especially for well-located family homes and A-grade investment properties. Though vendors will need to be realistic about price expectations.

There is still a lot of talk about rising interest rates and where they will stop. The current consensus from the major banks and economists is we should expect at least two more rate rises with the peak occurring around midyear. The expectation is it will peak around 3.5 to 4.00% and that the housing market will stabilise after this.

The rental market will remain very tight for 2023, ensuring investors have low to no vacancy and continue to achieve high rental yields.

We expect to be helping many home buyers and investors achieve their property dreams in 2023 and can’t wait to get going

Why does Adelaide continue to outperform other capital cities?

There are several contributing factors to Adelaide’s high performance in the current market and 8 of the leading reasons are below

- Affordability – Even with a median house price of $723,000 we are still on of the more affordable capital cities for homeowners and investors to buy in. Though it is getting harder to believer that just a few years ago at the end of 2019 it was just $440,000. And this still makes us more affordable compared to most of our sister capital cities including Sydney, Canberra, Melbourne, and Brisbane. We continue to remain somewhat of a mecca for interstate investors who are priced out of their own local markets and see value in our great city. Our average investment purchase price for the first quarter of 2024 for our clients is $657,785 which is a little below the city’s median house price.

- Properties for every budget – Continuing on from price discussion Adelaide and its surrounding suburbs offer genuine opportunities for buyers in most budget ranges. The market is bigger than people give it credit for we have purchased properties in over 100 suburbs in the last two years for clients. During the quarter we purchased multiple properties for our clients from a 3-bedroom home on a smaller block 7kms from the CBD for $540,000 for an investor to a 3-bedroom renovated period home 3.5kms from the CBD for $1.215 million for a homeowner. So, whether your budget is small or large there are opportunities for you.

- Strong Capital Growth – As mentioned above we have enjoyed double digit growth not only in the capital city but also regional in the last 12 months. And that is the average, there are always markets within markets and there are properties within suburbs that can achieve more. And if interest rates start coming down in the later part of this year as predicted, and borrowing power increases there will be areas that continue that northward trajectory for growth.

- Low Supply Levels – Nationally sales activities continue to trend higher, 6% higher in the last 12 months and 4.8% above the 5-year average. Adelaide’s sales volume has increased 6.8% in the last 12 months to March. And this may be due to there being a little more stock on the market. To date one of the key reasons for price growth in the market, has been low supply across the metro area. While many anticipated a good increase in listings for the first quarter, we really didn’t see this come into effect until April hit, after the Easter period.

- Low Vacancy Rates – It cannot be denied that whilst low vacancy rates are bad for tenants, they are good for investors/landlords. And now that we have (unfortunately) reclaimed top position for the lowest vacancy rates across the capital cities it does mean for landlords they are experiencing little to no vacancy times between leases. It is still important for landlords to keep their properties neat and tidy and properly maintained, those properties will always be snatched up first and a happy tenant makes for an easier and longer lease.

- High Rental Yields – The knock-on effect of low vacancy rates is that weekly rents have been on the rise. According to PropTrack since the March quarter 2020 to the December quarter 2023 Adelaide median advertised rents have increased 46%! We achieved our investor client’s average rental yield achieved of 4.7% for this quarter, which is above Australia’s (3.8%) and Adelaide’s (3.9%) gross rental yields reported by CoreLogic. The advantage of higher rental yields is the reduction of monthly outgoings for investors and potentially a positively geared or cashflow property.

- Cash Rich Buyers – Interstate buyers are still investing heavily in the local Adelaide market, whether they are relocating or investing in our strong but well priced market. Any relocators that have sold property in more expensive capital cities are able to bid aggressively and place high offers which is driving prices up for desirable properties.

- Unbeatable Lifestyle – Adelaide’s reputation as a lifestyle destination is growing rapidly. Whether you want to live near the sea, the hills, or the city there are lifestyle options for everyone. Pristine white beaches and world-class wineries can be reached by car in as little as twenty minutes from the city and we are a city known for its festivals, love of sport and world-class food and wine.

Looking forward

It seems everyone is excitedly waiting for that first interest rate cut however it is predicted that the first cut won’t be until the later part this year. So, for now the rates are stable which means buyers have a little more confidence is accurately calculating the cost of buying a property for the short to medium term.

Whilst we expect demand to continue outpace supply, we have noticed some mixed results in the local market. Family homes are still seeing strong competition, whereas there are fewer buyers at smaller homes or in your more expensive >$1,000,000 price points. We expect to see this continue until later this year, most likely to Spring when historically we see more buyers and sellers around for the pre-holidays rush.

The rental market will remain tight, with projected positive population growth in 2024 contributing to demand. There is speculation that the rapid growth in rents will slow due to the rising cost of living which means tenants cannot simply not afford to pay more.

Auction clearance rates continue to sit in the mid 70s which is a mostly balanced market, however we are always careful to remind people that unlike Melbourne and Sydney the bulk of our market activity occurs as private sales. So why Auction Clearance Rates are a good barometer of the market they are not the be all and end all in Adelaide.

We expect growth to remain steady in well located suburbs and properties. Vendors will need to be realistic with their prices, and there may be less examples of runaway auctions However, Adelaide is well positioned to maintain its strong growth, and to continue to out-perform many other capital cities.

Suburb to Watch | Paralowie "Bank for buck"

Overview

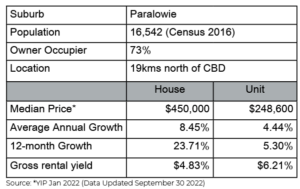

Paralowie is a residential suburb 19kms north of Adelaide and offers bang for its buck for home buyers or investors with smaller budgets, with a median house price of $450,000.

Paralowie is experiencing capital growth, demographic changes and demand through the area for housing due to its affordability.

With a population of 16,500 it is a well-serviced suburb with shops, schools, and public transport (buses). The suburb is bordered by the A1 on its east side providing direct and easy access to the CBD, and its southern border is Little Para River providing parks, reserves, and great walking trails.

Paralowie like many northern suburbs is still a growing and developing suburb. The majority of residents are owner occupiers (73%) but with rental yields achieving 5% or more and the low buy-in price more investors are being attracted to the suburb.

The properties themselves are a combination of older homes from the 70s right through the 90s to the naughties to new builds. Land is a plenty, block sizes range from a newer subdivided style at 350m2 through to large original blocks of 800m2.

The suburb is redefining itself; it has a vibrant multicultural community and is great for families. There are quality private and public schools. There is an emergence of new cafe’s, restaurants, specialty shops and retail outlets.

Paralowrie is one of the last pockets providing really affordable housing options still providing strong growth potential.

Purchase Example

4 Bedrooms | 2 Bath | 3 Car | 614m2 | $652,000

4 Bedrooms | 2 Bath | 3 Car | 614m2 | $652,000

Built in 1997 with a deceptively modern interior, 2 living and outdoor entertaining with swimming pool. Minutes away from shopping, schools. parks and public transport. An excellent example of why Paralowie is a prime location.

Buying an investment property for family to rent

by Katherine Skinner

Director

Katherine Skinner began her career in property over a decade ago in Melbourne working in Buyer’s Advocacy and Property Management. Returning to her hometown of Adelaide in 2009, Katherine quickly established a reputation as an exceptionally thorough and diligent practitioner, providing outstanding customer service coupled with a calm and positive attitude while working with some of Adelaide’s most highly regarded agencies. Katherine was named the REISA Buyers Agent of the Year 3 years running, a REIA National Awards Finalist twice, a Women in Real Estate Finalist.

0438 729 631 or email Katherine