Q1 2023 Property Market Insights Report

Quarter 1, 2023

Market Overview

By the end of Quarter 1 2023 we had experienced 10 straight interest rate rises as the RBA grappled with rising inflation. Consumer confidence dipped as the cost of living increased and servicing bank loans became a more expensive undertaking. The national property market slowed. However, Adelaide has been one of the most resilient capital cities.

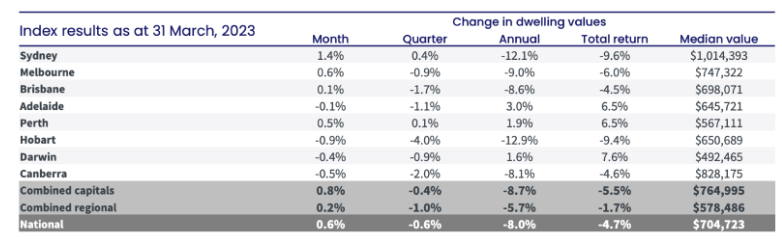

Whilst capital cities like Sydney and Melbourne experienced annual declines in dwelling values of 12.1 and 9% respectively by the end of Q1 2023 Adelaide experienced an increase of 3%. The country’s largest capital city value rise, as depicted below:

In fact, according to CoreLogic Adelaide’s housing values remain a stunning 41.2% above the levels recorded at the onset of COVID, and Regional SA values remain at a record high, 49.2% above March 2020 levels. So even though Adelaide has experienced a slight market softening in the first quarter, most property buyers are still sitting extremely far ahead for improved value of their property.

Also, history has demonstrated that Adelaide tends to trail the eastern capital cities responses to market changes but in a less volatile way. And in the last two months Sydney and Melbourne have both experienced growth, so the decline in Adelaide values may be short lived.

Why is Adelaide performing so well?

There are several contributing factors to Adelaide’s high performance in a softening market and 9 of the leading reasons are below

- Affordability – At $645,721 (CoreLogic, March), Adelaide has one of the most affordable median dwelling values of the major capital cities. In fact, the average property purchase price for our investor clients for 2023 is $562,916.

- Strong Capital Growth – There are always markets within markets and there are suburbs or property types that are still achieving strong capital growth. Suburbs like Paralowie and surrounding Northern Suburbs are seeing high demand from investors and owner-occupiers.

- Low Supply Levels – As vendors hesitate listing their properties thinking they will await the market; supply levels are down and demand for A-grade properties is outstripping supply. CoreLogic reported that listings were down 3.9% for Adelaide compared to the same time last.

- Low Vacancy Rates- Australia is in the midst of a rental crisis and nowhere is that more evident than in South Australia. According to CoreLogic, the combined capital cities vacancy rate finished the year at 1.2% with Adelaide the lowest at 0.4%. And there has been little change in the first quarter with Adelaide’s vacancy rate sitting at 0.5% (SQM Research).

- High Rental Yields – According to SQM Research weekly rents in Adelaide have increased by 13.6% in the last 12 months. The average rental yield in Adelaide is 4.65%, whilst the capital city average is 3.5%. High rental yields have the advantage of reducing monthly outgoings for investors. This can make holding onto investment properties easier for everyday Australians especially when the cost of living is increasing. Our tight rental market and high yields are safeguarding investors from the impact of interest rate rises and investors are still buying confidently.

- State Economic Wins – South Australia has enjoyed some big economic wins, and the main one in the news of late is the signing of the AUKUS deal which will see a new fleet of eight nuclear-powered submarines built in Adelaide at the Osborne building shipyard. As this $368 billion dollar project gains momentum it is going to affect the local areas due to job creation and increased community activity. There are some great suburbs around the area that are undervalued and offer seaside living close to the city.

- Cash-Rich Buyers – Interstate buyers, whether looking to relocate or invest are increasing competition for quality properties. If they have sold property in Sydney or Melbourne and are now buying in our local market, they are able to bid aggressively. We have noticed that local home buyers are becoming more conservative as the factor rate rises into their budgets. Families looking for 3-to-4-bedroom homes on larger blocks are being careful with their budgets as they have a number of living expenses they can’t reduce due to the nature of raising children.

- Properties for every budget – Adelaide and its surrounding suburbs offer genuine opportunities for buyers in most budget ranges. Whether your budget is $400,000 to $3 million (or more!) there is the perfect property for you.

- Unbeatable Lifestyle – Adelaide’s reputation as a lifestyle destination is growing rapidly. In 2021, Adelaide was named the third most liveable city in the world in the Global Liveability Index. Whether you want to live near the sea, the hills, or the city there are lifestyle options for everyone.

What’s the outlook for 2023?

South Australia is well-positioned to ride out the softening market. There is a general feeling of comfort around the market as there is an assumption of minimal movement in interest rates moving forward, allowing for some confidence through outgoings from day 1.

We don’t expect a surplus of distressed properties hitting the market in 2023 so buyer activity should continue to soak up fresh listings. Many vendors are testing the waters off-market before committing to listing, and we expect this trend to continue.

The rental market will remain very tight for 2023, ensuring investors have low to no vacancy and that rental yields should continue to rise. There is simply not enough rental stock for the amounts of tenants looking.

Suburb to Watch

Aldinga Beach- "Up and Comer"

Overview

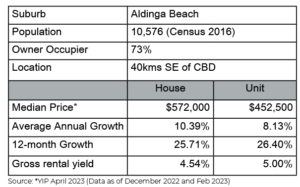

Aldinga Beach is a little patch of seaside bliss less than an hour from Adelaide and mere minutes from McLaren Vale’s award-winning wineries. Due to its rare reef formation, it is home to one of Adelaide’s best dive spots and a popular destination for day-trippers!

However, we think it is worth more than a visit and so do its 10,000 residents.

Not only does it have long stretches of sandy beaches, but it is also home to the Aldinga Conservation Park. Over 340 hectares of diverse plants, flora, and fauna which can be explored on one of its many walking trials.

The dining and shop scene is relaxed and consists of cafes, pubs, and fish-and-chip shops, many dotted along the coastline. Aldinga Central fulfills all your everyday shopping needs and services. Or 15 minutes away come rain, hail or shine you can explore Willunga Farmers Market for all your fruit and veg from 8 am to 12 pm every day.

For families, there is a local kindergarten, childcare centre and schools. Aldinga Beach Primary School (B-7) was the recent beneficiary of a $5 million dollar upgrade and nearby Seaford School (R-12) is available for secondary options.

At 40km from Adelaide, it is a little further away than some of the inner-city coastal suburbs but that is reflected in the house price. The current house median is $572,00 and that is after 25.71% growth in the past 12 months. For investors healthy rental yields are available, currently at 4.54%.

We think the popularity of this seaside suburb is going to continue to grow and it is currently undervalued. Whether you want the beach, the park, a farmers’ market or a cellar door it is all within easy reach.

Purchase Example

Built-in 2012 this 4-bedroom contemporary home is in a desirable location just a short distance from Aldinga Conservation Park and the Esplanade. Built with family living in mind with two living spaces, two bathrooms, a double lock-up garage, and an outdoor entertaining area.

Relocating back to Adelaide and buying their forever home

by Katherine Skinner

Director

Katherine Skinner began her career in property over a decade ago in Melbourne working in Buyer’s Advocacy and Property Management. Returning to her hometown of Adelaide in 2009, Katherine quickly established a reputation as an exceptionally thorough and diligent practitioner, providing outstanding customer service coupled with a calm and positive attitude while working with some of Adelaide’s most highly regarded agencies. Katherine was named the REISA Buyers Agent of the Year 3 years running, a REIA National Awards Finalist twice, a Women in Real Estate Finalist.

0438 729 631 or email Katherine