Q1 2024 Adelaide Property Market Report

Quarter 1, 2024

Market Overview

Well, we have reclaimed a top position we didn’t necessarily want.

Adelaide now has the tightest rental market in Australia. According to date released by PropTrack our vacancy rate has remained under 1 per cent since September 2021 – longer than any other capital city.

A healthy vacancy rate is around 3 per cent and at 0.83% vacancy rate the Adelaide rental market is in crisis for tenants. We know firsthand from rental open for inspections and receiving large number of applications how hard it is out there for tenants. There are no quick fixes, the state government needs to create more housing and work with local industry bodies to produce plans and solutions.

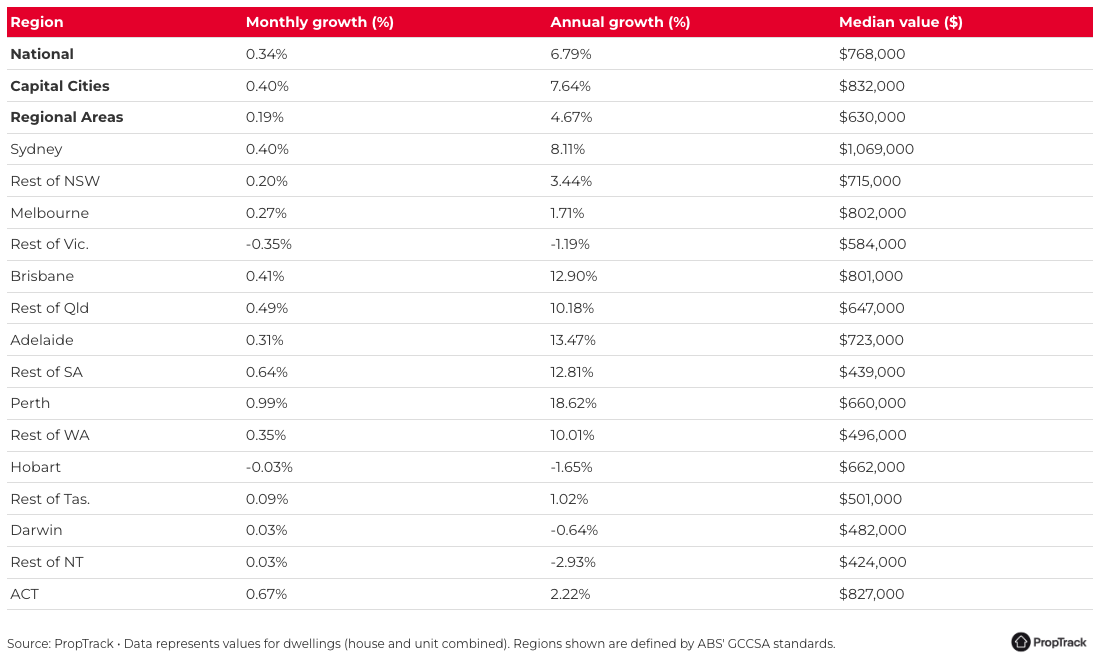

Let’s now look at the wider Adelaide market. Adelaide’s dwelling values remain at record highs, and we are one of the few cities and regions that has continued double digit growth in the last 12 months:

Why does Adelaide continue to outperform other capital cities?

There are several contributing factors to Adelaide’s high performance in the current market and 8 of the leading reasons are below

- Affordability – Even with a median house price of $723,000 we are still on of the more affordable capital cities for homeowners and investors to buy in. Though it is getting harder to believer that just a few years ago at the end of 2019 it was just $440,000. And this still makes us more affordable compared to most of our sister capital cities including Sydney, Canberra, Melbourne, and Brisbane. We continue to remain somewhat of a mecca for interstate investors who are priced out of their own local markets and see value in our great city. Our average investment purchase price for the first quarter of 2024 for our clients is $657,785 which is a little below the city’s median house price.

- Properties for every budget – Continuing on from price discussion Adelaide and its surrounding suburbs offer genuine opportunities for buyers in most budget ranges. The market is bigger than people give it credit for we have purchased properties in over 100 suburbs in the last two years for clients. During the quarter we purchased multiple properties for our clients from a 3-bedroom home on a smaller block 7kms from the CBD for $540,000 for an investor to a 3-bedroom renovated period home 3.5kms from the CBD for $1.215 million for a homeowner. So, whether your budget is small or large there are opportunities for you.

- Strong Capital Growth – As mentioned above we have enjoyed double digit growth not only in the capital city but also regional in the last 12 months. And that is the average, there are always markets within markets and there are properties within suburbs that can achieve more. And if interest rates start coming down in the later part of this year as predicted, and borrowing power increases there will be areas that continue that northward trajectory for growth.

- Low Supply Levels – Nationally sales activities continue to trend higher, 6% higher in the last 12 months and 4.8% above the 5-year average. Adelaide’s sales volume has increased 6.8% in the last 12 months to March. And this may be due to there being a little more stock on the market. To date one of the key reasons for price growth in the market, has been low supply across the metro area. While many anticipated a good increase in listings for the first quarter, we really didn’t see this come into effect until April hit, after the Easter period.

- Low Vacancy Rates – It cannot be denied that whilst low vacancy rates are bad for tenants, they are good for investors/landlords. And now that we have (unfortunately) reclaimed top position for the lowest vacancy rates across the capital cities it does mean for landlords they are experiencing little to no vacancy times between leases. It is still important for landlords to keep their properties neat and tidy and properly maintained, those properties will always be snatched up first and a happy tenant makes for an easier and longer lease.

- High Rental Yields – The knock-on effect of low vacancy rates is that weekly rents have been on the rise. According to PropTrack since the March quarter 2020 to the December quarter 2023 Adelaide median advertised rents have increased 46%! We achieved our investor client’s average rental yield achieved of 4.7% for this quarter, which is above Australia’s (3.8%) and Adelaide’s (3.9%) gross rental yields reported by CoreLogic. The advantage of higher rental yields is the reduction of monthly outgoings for investors and potentially a positively geared or cashflow property.

- Cash Rich Buyers – Interstate buyers are still investing heavily in the local Adelaide market, whether they are relocating or investing in our strong but well priced market. Any relocators that have sold property in more expensive capital cities are able to bid aggressively and place high offers which is driving prices up for desirable properties.

- Unbeatable Lifestyle – Adelaide’s reputation as a lifestyle destination is growing rapidly. Whether you want to live near the sea, the hills, or the city there are lifestyle options for everyone. Pristine white beaches and world-class wineries can be reached by car in as little as twenty minutes from the city and we are a city known for its festivals, love of sport and world-class food and wine.

Looking forward

It seems everyone is excitedly waiting for that first interest rate cut however it is predicted that the first cut won’t be until the later part this year. So, for now the rates are stable which means buyers have a little more confidence is accurately calculating the cost of buying a property for the short to medium term.

Whilst we expect demand to continue outpace supply, we have noticed some mixed results in the local market. Family homes are still seeing strong competition, whereas there are fewer buyers at smaller homes or in your more expensive >$1,000,000 price points. We expect to see this continue until later this year, most likely to Spring when historically we see more buyers and sellers around for the pre-holidays rush.

The rental market will remain tight, with projected positive population growth in 2024 contributing to demand. There is speculation that the rapid growth in rents will slow due to the rising cost of living which means tenants cannot simply not afford to pay more.

Auction clearance rates continue to sit in the mid 70s which is a mostly balanced market, however we are always careful to remind people that unlike Melbourne and Sydney the bulk of our market activity occurs as private sales. So why Auction Clearance Rates are a good barometer of the market they are not the be all and end all in Adelaide.

We expect growth to remain steady in well located suburbs and properties. Vendors will need to be realistic with their prices, and there may be less examples of runaway auctions However, Adelaide is well positioned to maintain its strong growth, and to continue to out-perform many other capital cities.

Suburb to Watch

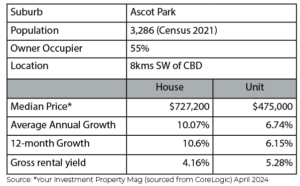

Ascot Park

Overview

Ascot Park is a cozy suburban gem nestled in the southwestern outskirts of Adelaide. Conveniently located between the city, the sea and the hills. For a relatively small suburb it still boasts a blend of residential tranquillity and urban convenience. This suburb offers a pleasant lifestyle for families and professionals alike.

If the word Ascot sounds a little familiar it is because it was named after Ascot Racecourse in England. However, whist Ascot Park does not have a racecourse it does have a few other facilities and features.

The Ascot Park Shopping Centre serves as the primary retail hub, catering to residents’ everyday needs with its selection of grocery stores, cafes, and specialty shops. From grabbing a morning coffee to picking up groceries for dinner, residents can easily access essential services without venturing far from home. Additionally, nearby Westfield Marion provides an extensive array of shopping, dining, and entertainment options, further enhancing the area’s appeal.

Location-wise, Ascot Park enjoys excellent connectivity to Adelaide’s CBD and surrounding areas. Situated just 10 kilometres south of the city centre, residents benefit from convenient access to major arterial roads, including South Road and Marion Road. Moreover, the presence of the Ascot Park railway station ensures hassle-free public transport connections, with regular train services linking the suburb to the city and beyond. Whether commuting to work or exploring Adelaide’s attractions, residents have options that make navigating the region easy.

Public transport accessibility is further enhanced by the extensive bus network serving Ascot Park and its surrounds. With several bus stops scattered throughout the suburb, residents can conveniently travel to neighbouring suburbs, schools, and recreational destinations.

Families considering a move to Ascot Park will appreciate its proximity to quality educational institutions. The suburb is within easy reach of several primary and secondary schools, providing parents with a range of options for their children’s education. Ascot Park Primary School, in the neighbouring suburb of Park Holme along with kindergarten options. Depending on where you lived in the suburb this could be a 5-minute walk. Additionally, nearby secondary schools such as Hamilton Secondary College offer comprehensive educational programs.

Ascot Park offers a diverse range of housing options to suit various preferences and lifestyles. The suburb features a mix of traditional single-family homes, modern townhouses, and low-rise apartment complexes, catering to individuals, couples, and families alike. Whether seeking a spacious family home with a backyard or a low-maintenance apartment, residents can find suitable accommodation to meet their needs within Ascot Park.

Purchase Example

3 Bedroom | 2 Bath | 2 Car | 514m2 | $985,000

A stylishly updated three-bedroom 30’s home offering a modern base with character details on a tree-lined street providing easy access to the CBD, coast and shopping in Ascot Park.

Listing Link

by Katherine Skinner

Director

Katherine Skinner began her career in property over a decade ago in Melbourne working in Buyer’s Advocacy and Property Management. Returning to her hometown of Adelaide in 2009, Katherine quickly established a reputation as an exceptionally thorough and diligent practitioner, providing outstanding customer service coupled with a calm and positive attitude while working with some of Adelaide’s most highly regarded agencies. Katherine was named the REISA Buyer’s Agent of the Year 3 years running, a REIA National Awards Finalist twice, a Women in Real Estate Finalist.

0438 729 631 or email Katherine