Q2 2024 Adelaide Property Market Report

Quarter 2, 2024

What a quarter for Adelaide and for us.

We have just had one our busiest quarters ever and whilst we would like to put it down to our growing company reputation for delivering excellent service it is also because Adelaide is so popular right now. Investors can’t get enough of it, relocators can’t get enough of it, and of course us locals that always knew how amazing it was, can’t get enough of it.

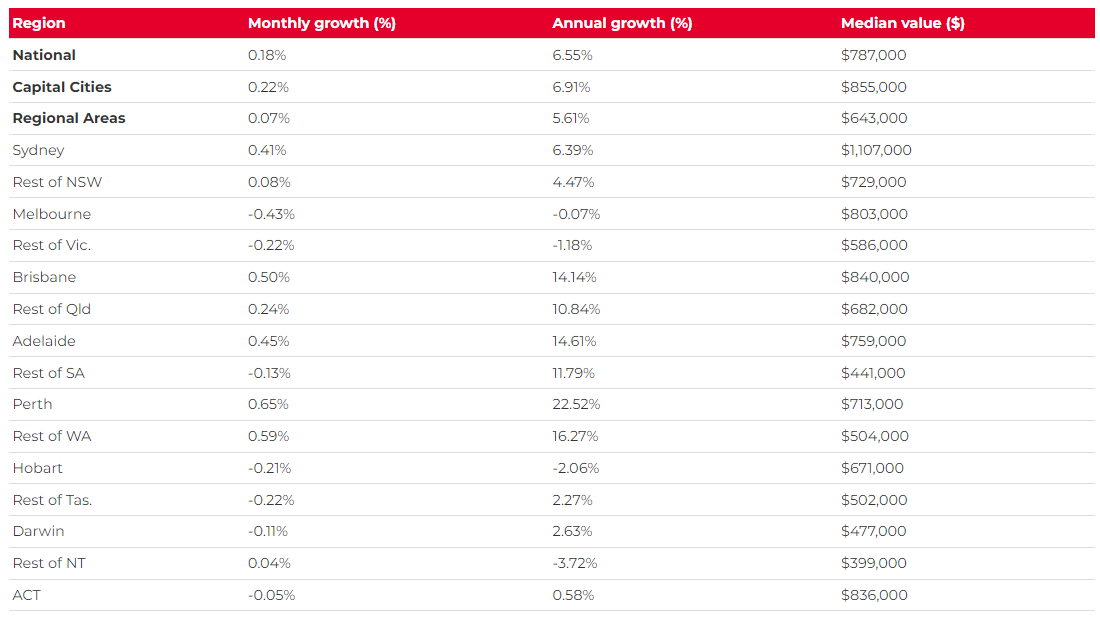

With interest rates on hold and most experts predicting a drop if not by the end of the year, then definitely next year Adelaide’s dwelling values remain at record highs, and we are one of the few cities and regions that has continued double digit growth in the last 12 months.

So, let’s look at the fundamentals of our hot property market.

Why does Adelaide continue to outperform other capital cities?

There are several contributing factors to Adelaide’s high performance in the current market and 8 of the leading reasons are below

- Affordability – I must admit with our fast-increasing median house price affordability has started to dip just a little bit. However, we still are one of the most affordable capital cities in Australia. With a median dwelling price of $749,000 we are still cheaper than our sister capital cities including Sydney, Canberra, Melbourne, and Brisbane. We continue to remain a location of choice for interstate investors who are priced out of their own local markets and relocators who are drawn to the lifestyle we offer. Our average purchase price for our clients so far this year is $895,153 for homeowners and $646,152 for investors.

- Properties for every budget – Let’s dive a little deeper into the cost of buying in Adelaide. The local market is bigger than people give it credit for we have purchased properties in over 100 suburbs in the last two years for clients. In 2024 we have purchased investment properties from $444,000 to $955,000. And for homeowners, an even bigger range from $397,500 for a First Home Buyer to a prestige home for $3,850,000! There really are opportunities for all types of buyers in Adelaide, whether budgets are big or small.

- Strong Capital Growth – We have enjoyed double digit growth not only in the capital city (14.61%) but also regionionally (11.79%) as well in the last 12 months. And that is the average, there are always markets within markets and properties within suburbs that can achieve more. And when interest rates start coming down and borrowing power increases these areas and properties will be set to enjoy further growth.

- Low Supply Levels –We definitely see it, but the numbers support it. Demand is outweighing supply. Traditionally listing numbers always fall in Winter, but this Winter is harsher than last Winter with total listings down 8.7% year on year. This is placing more pressure on prospective purchasers in all areas and budgets as less new stock hits the market. Despite the overall shortage, we have managed to secure 30+ properties for our clients this quarter. This proves, that it can still be done despite the difficult conditions purchasers are having to navigate.

- Low Vacancy Rates – It cannot be denied that whilst low vacancy rates are bad for tenants, they are good for investors/landlords. And it appears, unfortunately, that Adelaide has held onto to the mantle for the lowest vacancy rates across the capital cities at 0.6%. A healthy vacancy rate is around 3 per cent and at 0.6% vacancy rate the Adelaide rental market is in crisis for tenants. We know firsthand from rental open for inspections and receiving large numbers of applications how hard it is out there for tenants. It does mean for landlords they are experiencing little to no vacancy times between leases.

- High Rental Yields – The knock-on effect of low vacancy rates is that weekly rents have been on the rise. According to PropTrack since the March quarter 2020 to the December quarter 2023 Adelaide median advertised rents have increased 46%! Our investor clients are achieving an average rental yield of 4.5% so far this year, which is above Australia’s (3.7%) and Adelaide’s (3.8%) gross rental yields reported by CoreLogic. The advantage of higher rental yields is the reduction of monthly outgoings for investors and potentially a positively geared or cashflow property.

- Cash Rich Buyers – Interstate buyers are still investing heavily in the local Adelaide market, whether they are relocating or investing in our strong but well priced market. Any relocators that have sold property in more expensive capital cities are able to bid aggressively and place higher offers which is driving prices up for desirable properties.

- Unbeatable Lifestyle – Adelaide’s reputation as a lifestyle destination is growing rapidly. Whether you want to live near the sea, the hills, or the city there are lifestyle options for everyone. Pristine white beaches and world-class wineries can be reached by car in as little as twenty minutes from the city and we are a city known for its festivals, love of sport and world-class food and wine.

Looking forward

Regardless of interest rates the growth in our market has been phenomenal overall. We expect that supply levels will remain low and continuing placing pressures on the market. We do expect the traditional uptick of supply in Spring, but it may not be enough to meet demand – especially if interest rates do start to drop at the end of the year.

The rental market will remain tight, unfortunately there are no quick fixes here. There is speculation though that the rapid growth in rents will slow due to the rising cost of living which means tenants cannot simply not afford to pay more.

We expect growth to remain steady in well located suburbs and properties. The cost-of-living pressures means Vendors will need to be realistic with their prices, and there may be less examples of runaway auctions. However, Adelaide is well positioned to maintain its strong growth, and to continue to out-perform many other capital cities.

by Katherine Skinner

Director

Katherine Skinner began her career in property over a decade ago in Melbourne working in Buyer’s Advocacy and Property Management. Returning to her hometown of Adelaide in 2009, Katherine quickly established a reputation as an exceptionally thorough and diligent practitioner, providing outstanding customer service coupled with a calm and positive attitude while working with some of Adelaide’s most highly regarded agencies. Katherine was named the REISA Buyer’s Agent of the Year 3 years running, a REIA National Awards Finalist twice, a Women in Real Estate Finalist.

0438 729 631 or email Katherine